Lifetime Mortgage Reviews: 2025 Top Rated

Author: Paul Murphy Later Life Finance

We review the top lifetime mortgages, including Aviva, Royal London, Liverpool Victoria, Legal & General, More 2 Life, Canada Life, Just (formerly Just Retirement), Standard Life, Scottish Widows, Crown & Livemore.

Ready to compare deals with our expert advisers?

If you considering a lifetime mortgage but feeling overwhelmed by the information available, Later Life Finance are here to help you uncover the truth behind lifetime mortgage reviews. By understanding how these mortgages work, you can make an informed decision with confidence.

We have access to the best equity release companies and schemes to source you the correct solution for your needs.

Lifetime Mortgage Reviews: What's best For My Needs?

Lifetime mortgages provide homeowners aged 55 and over with the ability to access equity in their home without selling or making monthly payments, (but still allow payments to preserve equity).

When selecting a provider, factors such as interest rates, fees and plan flexibility are essential for finding the best solution available.

- Choosing an Equity Release Council member provides a negative equity guarantee.

- You should consider discussing your plans with family members before making any decisions regarding your finances.

- We explore what are the pitfalls of a lifetime mortgage, and our qualified expert advisers will help you decide which equity release mortgage lender offers the best plan for you, and they will explain how to apply for a lifetime mortgage.

Our Lifetime mortgage reviews provide valuable insights into customer satisfaction and potential pitfalls to consider when applying for a lifetime mortgage.

Are lifetime mortgages a good idea, and what should you look out for?

When comparing providers, it’s essential to consider both positive and negative reviews, as they can help you make an informed decision that fits your unique needs and preferences.

Let’s explore some of the most common themes found in lifetime mortgage reviews and what they could mean for your decision-making process.

Lifetime Mortgage Reviews: Who Is The Best Provider?

With a wide range of lenders now available, deciding which lender is best for your personal needs and longer-term plans can feel like a minefield.

For example, you may not want a lifetime term mortgage, but the flexibility of a lifetime mortgage may appeal to you.

You may plan to downsize in the future and require a flexible solution to move home and settle the mortgage.

Or you simply may want to stay in your home for life, but need the assurance you’re sourcing the best possible deal.

As a specialist broker Later Life Finance review the range of lifetime mortgages available to ensure you access the best outcome for your specific needs and priorities.

The best providers include:

- Standard Life

- Aviva

- More to Life

- Legal & General

- Livemore

- Canada Life

- Royal London

- Just

- Liverpool Victoria

We compare the full range of plans from each lender to secure you the best deal.

Top Equity Release Company Features

Canada Life- Lifetime mortgage with downsizing protection

Legal & General- RIO & interest only lifetime mortgages

Aviva- Flexible underwriting, voluntary repayment lifetime mortgages

Just- High lump sum plans and medically enhanced plans

LV= Drawdown plans

Pure Retirement- Range of funders to select

Livemore-RIO and Lifetime mortgages

More to Life- Lump sum and drawdown plans,voluntary repayments

Later Life Finance– whole of market broker service

Royal London- Lump sum and drawdown plans, voluntary repayments

Factors to Consider When Choosing a Lifetime Mortgage Provider

When choosing a mortgage provider, it’s important to consider factors such as:

Interest rates

Fees

Flexibility

Reputation

By thoroughly researching and comparing providers, we can ensure that you’re getting the best deal and the most suitable plan for your specific needs.

In this section, we’ll explore some of the key factors to consider when evaluating mortgage providers and how to make the most informed decision possible.

Interest Rates and Fees

Comparing lifetime mortgage interest rates and fees among providers is crucial to ensure you’re getting the best deal on your mortgage.

By carefully comparing the interest rates and criteria of each lender, Later Life Finance can ensure you find the correct solution for your overall requirements.

Reputation and Customer Service

Researching the provider’s reputation and customer service is essential to ensure a positive experience throughout the mortgage process.

This includes:

Reading customer reviews

Checking for membership with organisations such as the Equity Release Council

Ensuring the provider is regulated by the Financial Conduct Authority

Positive Reviews: Customer Satisfaction and Trustworthiness

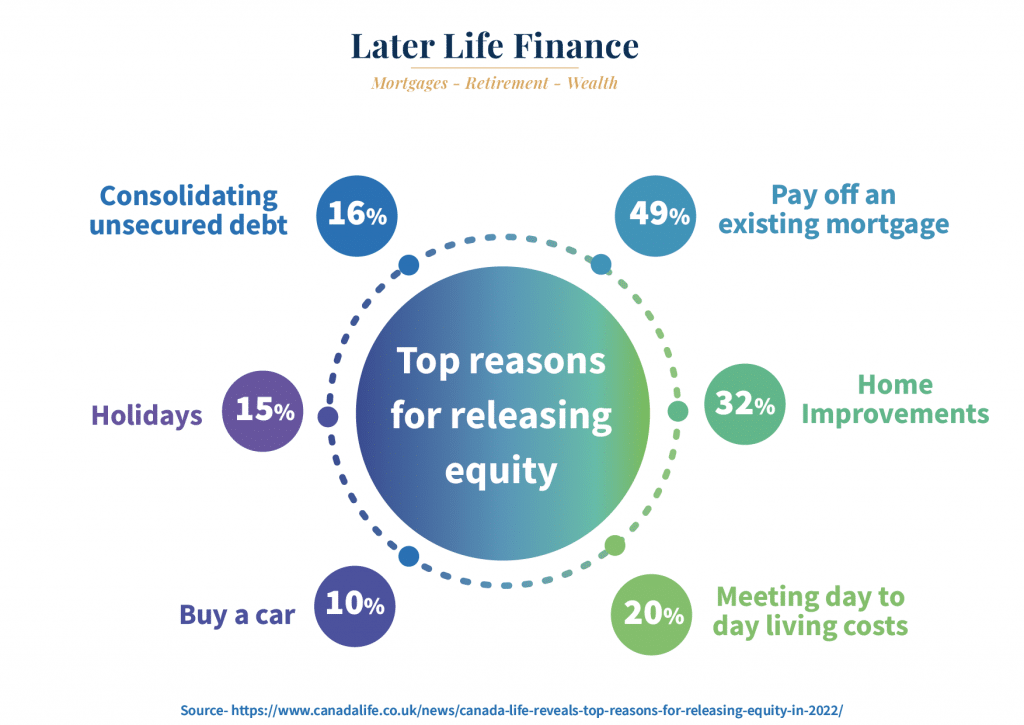

Positive reviews often emphasise the certain benefits of lifetime mortgages lenders over another, such as flexibility with the type of property they may lend on, flexible repayment options, and competitive interest rates.

These reviews can also highlight the trustworthiness of providers, as many are regulated by the Financial Conduct Authority (FCA) and the Equity Release Council (ERC).

The FCA ensures that customers receive high-quality advice, while the ERC provides a guarantee that the amount owed will never exceed the value of the home, offering peace of mind for homeowners considering a lifetime mortgage.

Additionally, the financial services compensation scheme plays a role in protecting consumers in the financial market.

Negative Reviews: Common Complaints and Red Flags

On the other hand, negative reviews may reveal common complaints and red flags, such as hidden fees, poor customer service, or inflexible terms.

These issues could impact your overall experience with a mortgage provider, making it essential to carefully consider both the pros and cons before making a decision.

By thoroughly researching and comparing providers, we ensure that you’re choosing a mortgage plan that best suits your individual needs and preferences.

Ready to compare the best equity release providers list with our expert advisers?

Get your free calculation, compare the market with a free expert review, get interest projections & access to our exclusive broker deals!

Registered providers

Summary

Later Life Finance review all options when comparing the market for you.

We are members of the equity release council. To book an appointment with an expert without any obligation click here

Dealing with an adviser with access to the whole equity release market will enable you to access the best equity release companies and schemes available, which will help match your requirements with the most appropriate solution available and the review the top providers and deals for your needs on an impartial basis as a specialist broker.