How Much Equity Can You Release From Your Home?

How much can you release from your home?

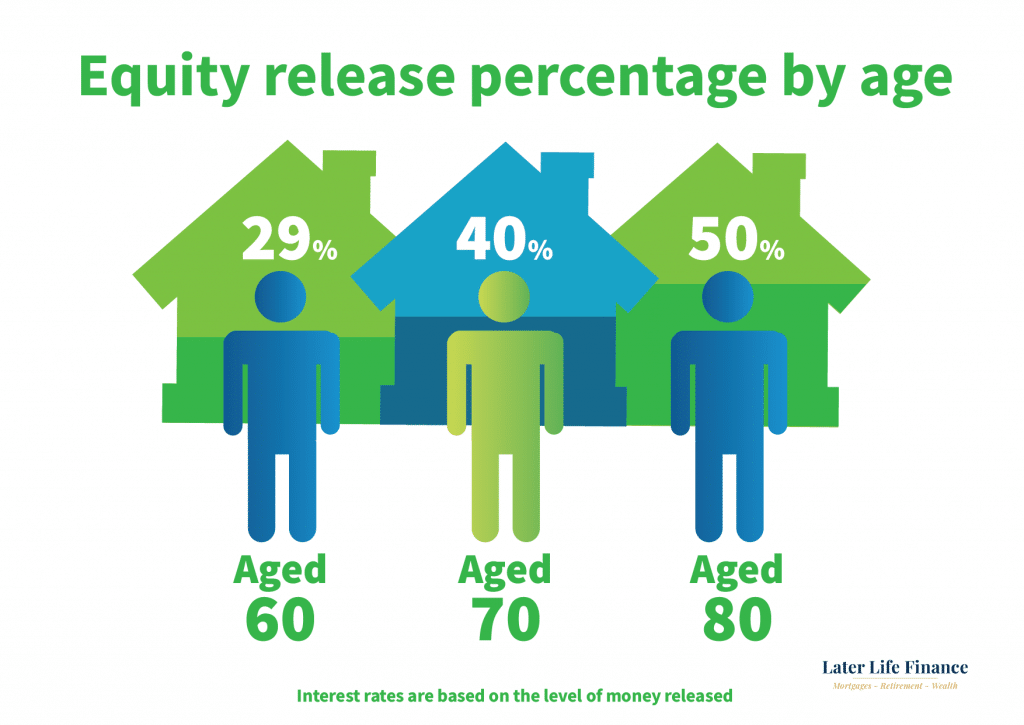

The amount of equity you can release from your home depends on two main factors, the value of your house and your age.

The typical range for equity release is between 20% and 60% of your property's value. However, in some cases, enhanced lending terms might allow you to access even more equity.

Request a free review with our experts at Later Life Finance for a personalised illustration.

Get your free equity release calculation..

How much can you release with equity release?

The amount of equity you can release from your home depends on two main factors, the value of your house and your age.

The typical range for equity release is between 20% and 60% of your property’s value. However, in some cases, enhanced lending terms might allow you to access even more equity.

There are online calculators available to help you estimate how much equity you might be able to release. It’s important to consider all your options and speak with a qualified adviser before making a decision about equity release.

The experts at Later Life Finance can assist you with exploring your options.

What impacts how much equity I can release?

The main factors affecting how much equity you can release from your home are:

- How old you are

- Your health

- How much your home is worth

- What type of property your home is, where it’s located and any unusual features it might have, such as a flat roof, or near commercial premises

- Leasehold or Freehold

For example, certain providers won’t lend against properties with thatched roofs, a flood risk or near commercial premises such as takeaways or pubs.

Our lifetime mortgage calculator will help you get started with how much equity you can borrow from your home.

Our experts will help you determine how much equity you have in your home with a free review of all your options.

How much equity can I release after my mortgage is paid off?

Equity release lenders will allow you to borrow a percentage of the value of your home.

The equity in your home is the value minus any mortgage or secured lending you may have. For example, if you have a home valued at £300,000 and mortgage of £100,000, this means you have £200,000 of equity in your home.

If you release equity from your home, your existing secured lending will need to be repaid from the equity you are borrowing against the value.

The lender instructs a valuation at the outset, and part of the surveyors checks are to ensure the property is in good condition and repair.

Later Life Finance will help you understand how much equity you have and determine how much equity you can release from your home, the best way to setup a lifetime mortgage, and how to pay the interest to avoid your equity being eroded by compound interest.

Calculate the percentage you get from your home with equity release