Who Are The Top 10 Best Equity Release Companies In 2025?

Author: Paul Murphy Later Life Finance

The top 10 best equity release companies in 2025 include Aviva, Royal London, Liverpool Victoria, Legal & General, More 2 Life, Canada Life, Just (formerly Just Retirement), Standard Life, Scottish Widows, Crown & Livemore.

Ready to compare deals with our expert advisers?

Choosing The Right Provider: The Best Equity Release Companies Explained

If you’re considering raising money from your home, navigating the landscape of equity release can feel like a complex journey, filled with many choices (providers, product features, repayment options) and important considerations (interest rates, flexibility, long-term impact on equity and inheritance, for example).

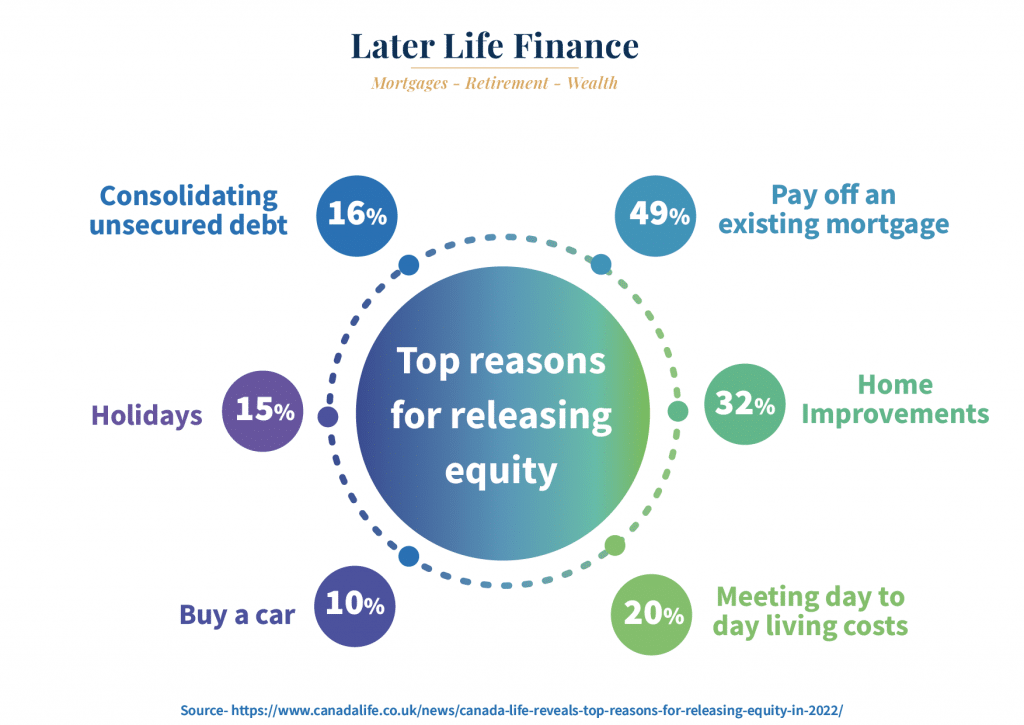

For homeowners aged 55 and over, unlocking the wealth tied up in your home can provide much-needed funds for a variety of purposes (mortgage repayment, home improvements, lifestyle enhancements). But with so many providers offering different options, how do you find the best equity release companies for your specific needs or requirements?

Modern lifetime mortgages offer great levels of flexibility, providing a popular form of lending to access tax-free wealth from your home. This guide will demystify the process, answering your crucial questions (provider suitability, potential pitfalls, borrowing limits) and comparing the features (interest rates, product variations, customer service) of leading providers to help you make an informed decision to safely enjoy the wealth in your home.

Who are the best companies for equity release?

The UK equity release market is quickly growing with increased demand for financial freedom in our golden years. Featuring a number of highly reputable companies (financial institutions, insurance providers, specialist lenders) that adhere to the stringent standards of the Equity Release Council (ERC) & Financial Conduct Authority regulation.

While “best” is subjective and depends on your individual circumstances, the leading providers (Aviva, Royal London, Liverpool Victoria (LV=), Legal & General, More 2 Life, Canada Life, Just (formerly Just Retirement), Standard Life, Scottish Widows, Crown, and LiveMore) consistently offer competitive deals (interest rates, plan flexibilities, cashback incentives) and excellent customer support (advisers, online resources, helplines).

Each of these companies brings unique strengths (competitive rates, innovative products, strong customer service) to the table, and understanding their individual offerings is key to finding your ideal match.

We address these questions and compare each companies features, deals, pros and cons of each scheme to help avoid any pitfalls with choosing the best equity release provider.

When you are ready to compare plans in detail, our Lifetime mortgage calculator will help you get started with finding the best companies for equity release & top providers.

Who Are The Top 10 Equity Release Companies?

Canada Life- Lifetime mortgage with downsizing protection

Legal & General- RIO & interest only lifetime mortgages

Aviva- Flexible underwriting, voluntary repayment lifetime mortgages

Just- High lump sum plans and medically enhanced plans

LV= Drawdown plans

Pure Retirement- Range of funders to select

Livemore-RIO and Lifetime mortgages

More to Life- Lump sum and drawdown plans,voluntary repayments

Later Life Finance– whole of market broker service

Royal London- Lump sum and drawdown plans, voluntary repayments

Who Are Later Life Finance?

As a specialist equity release broker, Later Life Finance review the whole market to source you the best deals.

We are well positioned to review & compare the top 10 equity release provider list based on our experience to help you navigate your options.

We have access to exclusive broker deals to save you time and money when comparing the best equity release providers and lifetime interest only mortgages.

Equity release provides a solution with flexible mortgages for older borrowers, as lifetime mortgages can offer a greater level of financial freedom for homeowners to enjoy the retirement you’ve worked for.

If you are considering equity release to pay off an interest only mortgage, finding the best provider for your needs is crucial to get the most suitable solution for your current and long-term plans.

Which Provider is Best for You, and Why?

Determining the “best” provider is a highly personal exercise, as it depends on your age, property value, health, and financial goals & priorities (early repayment options, moving home, interest payments). Here’s a look at what some of the top companies (Aviva, Legal & General, More 2 Life) are known for, and what sets them apart:

- Aviva: As one of the longest-standing providers (lenders, firms, institutions), Aviva is renowned for its wide range of lifetime mortgage products (lump sum, drawdown, interest-serviced options) and flexible features (downsizing protection, early repayment charge waivers, fixed rates). They cater to a broad spectrum of applicants (older borrowers, those with varied property types, individuals seeking specific flexibilities).

- Legal & General: A major player, Legal & General offers competitive rates (fixed, variable, tiered) and robust solutions (lump sum, drawdown, optional payment plans). They are often a strong choice for those with high-value properties (residential homes, some unique dwellings, larger estates) or those seeking specific benefits (low early repayment charges, inheritance protection options, guaranteed cash reserves).

- More 2 Life: Known for innovation and a diverse product portfolio (enhanced lifetime mortgages, flexible drawdown, interest-serviced products), More 2 Life is often able to provide higher borrowing amounts (loan-to-values, maximum releases, cash sums) to those with certain health or lifestyle factors (medical conditions, past illnesses, specific occupations).

- Just (formerly Just Retirement): Offers a comprehensive suite of later-life products (lifetime mortgages, home reversion plans, care funding solutions). Just is particularly strong for those seeking tailored options (flexible interest payments, inheritance protection, specific age-related terms).

- Canada Life: With a growing presence, Canada Life provides a range of lifetime mortgage schemes (lump sum, drawdown, interest payment options) that can be highly flexible, allowing clients (homeowners, borrowers, customers) to customise features (early repayment charge periods, interest payment flexibility, further advance options) to their individual circumstances (age, health, property type).

The equity release market in the UK is diverse, featuring a number of highly reputable companies (financial institutions, insurance providers, specialist lenders) that adhere to the stringent standards of the Equity Release Council (ERC) & regulated by the Financial Conduct Authority.

The market has evolved to offer a wide range of plans including the flexible lifetime interest only mortgages, which allow you to avoid or reduce compound interest, with many plans offering the option to downsize and settle the mortgage early.

While “best equity release company” is subjective and depends on your individual circumstances, the leading providers (Aviva, Royal London, Liverpool Victoria (LV=), Legal & General, More 2 Life, Canada Life, Just (formerly Just Retirement), Standard Life, Scottish Widows, Crown, and LiveMore) consistently offer competitive deals (interest rates, plan flexibilities, cashback incentives) and excellent customer support (advisors, online resources, helplines).

Each of these companies brings unique strengths (competitive rates, innovative products, strong customer service) to the table, and understanding their individual offerings is key to finding your ideal match.

Later Life Finance will compare each company’s criteria (age limits, property types, health considerations), deals (interest rates, product features, loan amounts), and pros and cons (benefits, drawbacks, long-term implications) to help avoid any pitfalls or traps when choosing the best equity release provider

Should You Avoid Any Particular Equity Release Companies?

Generally, there aren’t specific companies (firms, lenders, providers) to avoid outright if they are regulated by the Financial Conduct Authority (FCA) and are members of the Equity Release Council (ERC). These bodies (regulators, industry associations, oversight organisations) ensure that providers adhere to strict safeguards (No Negative Equity Guarantee, right to remain in your home, fixed or capped interest rates) designed to protect homeowners.

However, you should avoid brokers (advisors, intermediaries, consultants) who are tied to a single provider or a very limited panel of lenders (banks, building societies, limited panel equity release firms). This significantly restricts your options (product choices, competitive rates, tailored solutions) and may not lead to the most suitable outcome for your finances (estate, savings, long-term plans). Always seek independent, whole-of-market advice (guidance, recommendations, expert opinions).

Can You Be Declined Equity Release, and How Much Can You Borrow?

Yes, it is possible to be declined for equity release, though many applications (proposals, requests, submissions) are successful. Providers (lenders, companies, firms) have specific criteria (age limits, property conditions, loan-to-value requirements) that your application must meet. Common reasons (property issues, applicant age, minimal equity) for decline include:

- Property Suitability: Properties with unusual construction methods (timber frame, concrete, prefabricated), significant structural issues (damp, subsidence, major repairs needed), or unusual locations (next to commercial premises, in high flood risk areas, near industrial sites) may be deemed unsuitable.

- Age: The youngest homeowner must typically be 55 or over. Some schemes (products, plans, options) may have higher minimum age requirements (60, 65, 70).

- Insufficient Equity: You may not have enough equity in your property, especially if you still have a large outstanding mortgage (capital, debt, loan) that needs to be repaid from the released funds.

Intended Use of Funds: While rare, some lenders (banks, providers, firms) may decline applications if the funds are intended for highly speculative or high-risk investments (cryptocurrencies, unproven businesses, volatile markets) due to responsible lending guidelines.

How Much Can You Borrow?

The amount you can borrow on a Lifetime Mortgage largely depends on several key factors (your age, property value, health status):

- Your Age: Generally, the older you are, the higher the percentage of your property’s value you can release.

- Property Value: The loan amount is a percentage of your home’s current market value.

- Health and Lifestyle: Some providers (lenders, companies, firms) offer “enhanced” terms or higher loan-to-values if you have certain health or lifestyle conditions (smoking, high blood pressure, diabetes).

Typically, you can release anywhere from 20% to 60% of your property’s value, with the average initial loan around £100,000 to £150,000, though this varies greatly. Our Lifetime Mortgage calculator can help you get an initial estimate (indication, approximation, guide) of how much you could potentially borrow based on these details (age, property value, general health).

In the world of equity release companies, interest only lifetime mortgage providers and schemes, the range of choice can seem overwhelming. Using an equity release broker will help you source the best solution for your specific needs when considering current lifetime mortgage rates for over 60’s.

Compare Plans and Find Your Best Provider Today

If you are considering equity release, perhaps to pay off an interest-only mortgage (loan, debt, capital repayment), finding the best provider for your needs (financial security, retirement income, lifestyle goals) is crucial to getting the most suitable solution or answer for your current and long-term plans (financial future, estate planning, family legacy).

We address these questions (suitability, risks, benefits) and compare each company’s features (interest rates, product flexibility, customer support), deals (special offers, competitive terms, borrowing limits), pros and cons (advantages, disadvantages, long-term implications) of each scheme to help avoid any pitfalls (unexpected costs, unsuitable terms, future regrets) with choosing the best equity release provider.

When you are ready to compare plans (options, schemes, products) in detail, our Lifetime Mortgage calculator will help you get started with finding the best companies (providers, lenders, firms) for equity release and top providers (lenders, firms, institutions). Your personalised illustration (quote, projection, scenario) will highlight the best options available based on your unique situation (personal circumstances, property details, financial goals).

Get your free calculation & compare the market with a free expert review. Get interest projections & deal direct with an adviser. Access our exclusive broker deals!

Registered providers

Equity release brokers

The choice of equity release brokers advertising on TV and Google can seem overwhelming, knowing who to trust with such an important decision is not to be taken lightly.

Later Life Finance are an FCA authorised equity release broker you can rely on for expertise and knowledge across all lenders, schemes and criteria to save you time and stress.

Why do our customers choose Later Life Finance over our competitors? It’s simple, our service is first-class!

- Personal service with a single point of contact. No call centres, and a wealth of expertise

- Lifetime care and advice pledge. Long-term peace of mind with a private-client level of service

- High Net Worth mortgage broker- Access bespoke deals, cash backs and exclusive deals not widely available

- Lender expertise- As a specialist broker, we have access to bespoke lending solutions and have established strong working relationships with lenders and solicitors, which helps the process run as smoothly as possible for you.

To help you find the best deal our equity release mortgage calculator will provide instant results.

It’s important the deal fits your requirements and is ‘future proof’, so you can be confident the equity release plan is flexible for early repayment, if this is part of your overall plan.

Summary

Understanding all your options is key to deciding which equity release company is correct for your specific circumstances, and knowing which companies to avoid to ensure you source the best solution is equally important.

Access to a qualified equity release adviser who are Equity Release Council registered will ensure you receive independent, expert advice.

Later Life Finance are members of the equity release council. To book an appointment with an expert without any obligation click here

Dealing with an adviser with access to the whole equity release market will enable you to access the best equity release companies and schemes available, which will help match your requirements with the most appropriate solution available and the best equity release company, provider and deal for your needs on an impartial basis as a specialist broker.