Lifetime Mortgage Calculator: Compare Lifetime Mortgage Quotes

The maximum percentage of lending on a lifetime mortgage has changed significantly in 2024 due to the launch of a new interest only lifetime mortgage.

From the minimum qualifying age 50, you could release around 55%, subject to your income.

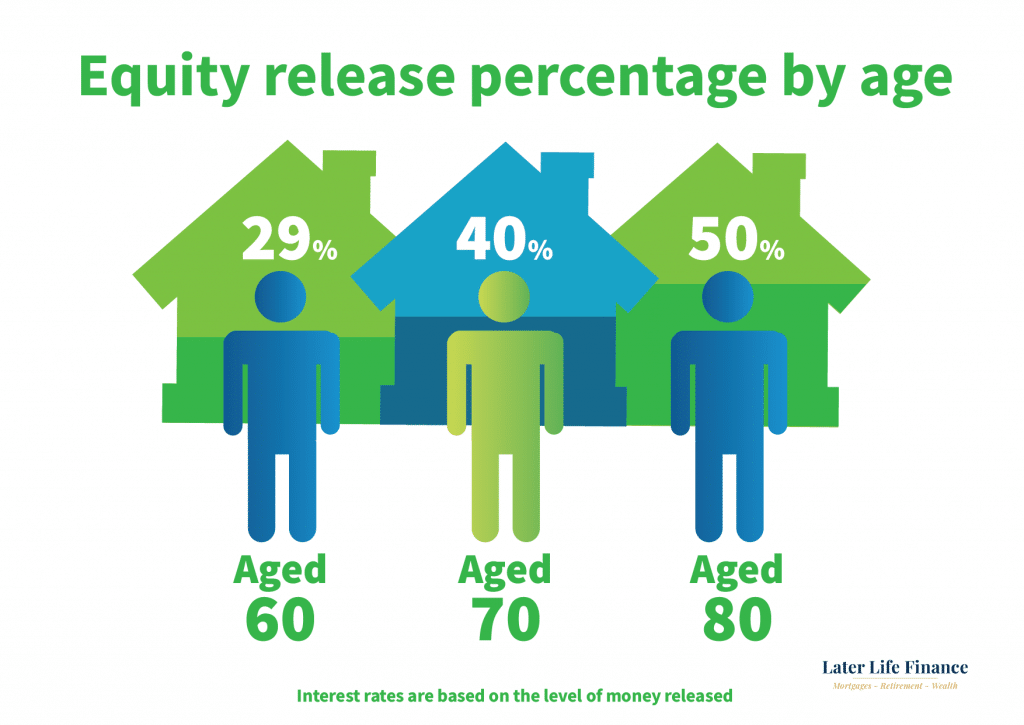

From age 55 you could release around 22%, and this increases each year by 1% up to around 55% at age 90.

Get your free lifetime mortgage calculation...

Next, book your market comparison with your free review

Updated June 2024 -Author Paul Murphy

Later Life Finance Limited.

Lifetime mortgage equity release calculator

Access exclusive deals with our lifetime mortgage equity release calculator and discover the wide range of flexible options available to you with lifetime mortgages.

If you are considering raising the hidden wealth from your home and how much you can borrow on a lifetime mortgage, it’s an option to consider.

A cash injection to enhance your best years may be attractive, but it’s important to get the right solution for you.

Later Life Finance are a specialist lifetime mortgage broker. If you decide to proceed with an application, our experts will help you without any pressure, obligation or upfront fees.

We discuss all your lifetime mortgage options, the advantages and disadvantages and the alternatives to consider.

We have access to the whole market for your added peace of mind we will find you the best deal available with our expert lifetime mortgage advisers.

How much equity can i release from my home?

With certain interest only lifetime mortgages you could release around 55% of the value of your home, subject to your income.

For voluntary repayment lifetime mortgages (which make up the majority of the market), income is not taken into consideration, from age 55 you could release around 22%, and this increases each year by 1% up to around 55% at age 90.

What is the maximum equity release on a property?

The maximum percentage of lending on a property with a lifetime mortgage has changed significantly in 2024 due to the launch of a new interest only lifetime mortgage.

From the minimum qualifying age 50, you could release around 55%, subject to your income.

From age 55 you could release around 22%, and this increases each year by 1% up to around 55% at age 90.

How do lifetime mortgages calculators work?

The lifetime mortgage calculator uses a Loan-to-Value ratio, which is the percentage of the property’s value that can be borrowed.

The LTV is based on the homeowner’s age and value of the property. Generally, the older the homeowner, the higher the LTV.

The calculators provide a guide, but to really understand your options is best to speak with an expert to understand how much equity you can release from your home.

For example, there are lump sum and drawdown options to consider, along with plan features such as early repayment charges and voluntary repayments.

It’s crucial to discuss your complete range of options to understand what’s best for your specific requirements.

Lifetime mortgage calculator money saving expert

What does Martin Lewis think about lifetime mortgages, and does the money saving expert have a lifetime mortgage calculator?

The expert’s advice is to only consider a lifetime mortgage after seriously considering all the alternative options, and to deal with an equity release council registered expert.

Specialist broker Later Life Finance have expert advisers who will help you navigate all your options. We compare lifetime and retirement mortgages to find the correct solution for your requirements.

We help you understand the advantages and disadvantages of lifetime mortgages to avoid the pitfalls of selecting the wrong plan from the marketplace.

Lifetime mortgage calculators with no personal details

Would you like to calculate your equity without providing all your personal information?

Later Life Finance help you with this information without the hassle.

Our calculators provide a guide, but to really understand your options is best to speak with an expert when understanding what percentage you can release from your home.

Once you’re ready, It’s useful to discuss your complete range of options to understand what’s best for your specific requirements.

Get your free lifetime mortgage calculation...

How can a lifetime mortgage benefit you?

Help family with a gift

Dream Holiday

Cash Lump Sum

Pay Off your Mortgage

Interest only lifetime mortgage calculator

To compare the top 10 equity release companies, we have reviewed and listed the best providers to help you compare your options, including lender features, such as downsizing protection, voluntary repayments and more.

- Lifetime mortgages allow homeowners over 55 to borrow against your home with the option to make voluntary repayments to preserve more of your equity. (Payments are optional).

- No income or affordability checks to qualify, and takes around 8 weeks to arrange a lifetime mortgage

- The money is repaid at the end of your lifetime from the sale of your home.

- To check your eligibility and how much equity you can release, try our free equity release calculator

- Borrow between 20% and 50% of your home’s value, depending on age; enhanced mortgages available for those health problems.

- Negative equity guarantee for Equity Release Council members, which ensures you and your estate are fully protected

- Possible to move home and take the lifetime mortgage if moving to a suitable property

- Drawdown plans available to stage the borrowing over the coming years, providing more flexibility

- Get professional advice to understand if a lifetime mortgage is suitable.

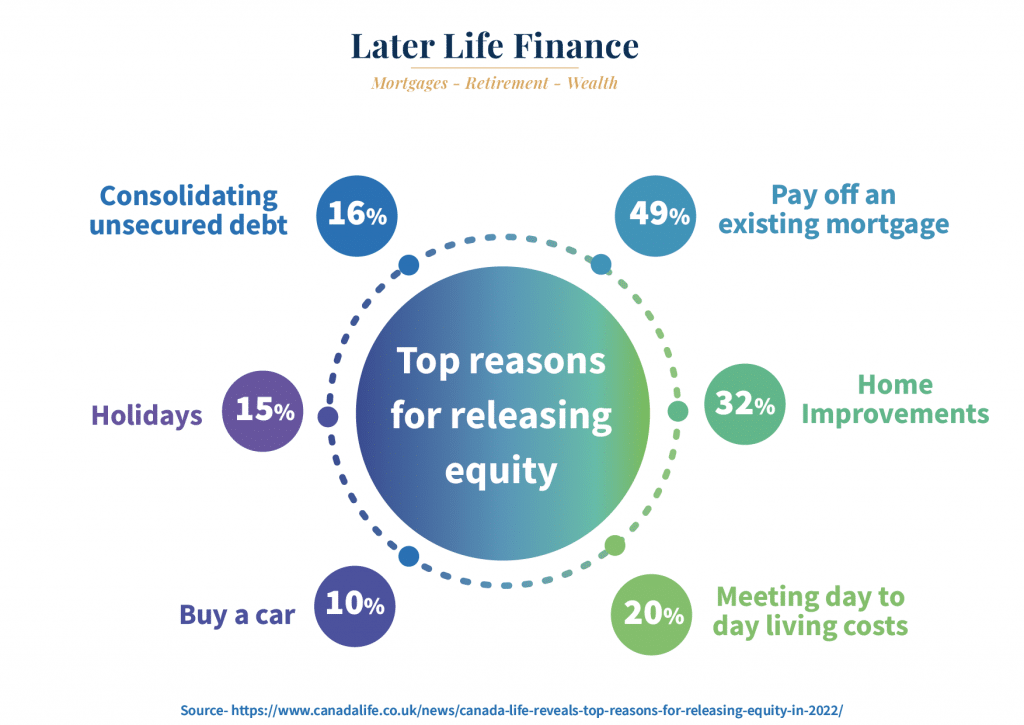

The most popular reasons for using lifetime mortgages in 2023

How do you calculate a lifetime mortgage?

How do you calculate a lifetime mortgage, and what is the maximum loan to value of cash available?

There are a few factors that affect how much equity you could release from your home with a lifetime mortgage.

It’s important to remember each lender has different criteria.

As a guide, the following information is used to calculate how much money you could release.

The factors used to calculate this are:

- Your age (or the age of the youngest person if you own the property jointly)

- The type of home you own (house/flat)

- Your home’s valuation (lenders carry out a valuation)

- Your health and lifestyle

- Whether you have a leasehold on the property

- How you arrange your lifetime mortgage (as one cash lump sum, or a lump sum with a cash reserve facility)

- Choosing a lenders inheritance guarantee to leave a set percentage of your home’s value behind

Who offers the best lifetime mortgage?

- LV=

- Legal and General

- LiveMore

- More2Life

- OneFamily

- Pure Retirement

- Scottish Widows

- Standard Life.

- Royal London

- Canada Life

- Aviva

- Just

Is there a credit check for a lifetime mortgage?

As part of the application process for a lifetime mortgage, the lender may check your credit report.

Since lifetime mortgages do not have mandatory repayments, any missed payments on credit are not necessarily an issue for lending.

If you have any defaults or CCJ’s on your credit agreements, the lender may require these to be settled.

Any secured lending must be settled as part of the agreement as a lifetime mortgage is the first legal charge on the property.

Book a free, no obligation discovery call with our expert advisers

What is the maximum percentage for a lifetime mortgage?

The minimum age for a lifetime mortgage is 55.

At age 55 you can release up to 27% of your home’s value with increases each year with age by 1%. The maximum percentage you can release from your home is 58% at age 82.

Factors impacting on how much you can release include property type and whether you take a lump sum or drawdown plan.

What are the pitfalls of a lifetime mortgage?

How much can I borrow on a lifetime interest-only mortgage?

A lifetime interest only mortgage is based on your age and property value. The range of options available is increasing, with flexible lifetime mortgages now allowing interest and capital repayments.

At age 55 you can release up to 27% of your home’s value, which increases each year with age by 1%. The maximum percentage you can release from your home is around 58% at age 82.

What is the difference between equity release and a lifetime mortgage

A lifetime mortgage is the most popular form of equity release for homeowners over 55. Equity release is simply a term for releasing the equity from your home. A lifetime mortgage provides a flexible method of raising tax free equity in the form of cash.

What happens when someone dies with a lifetime mortgage?

Your lifetime mortgage plan is repaid when the last surviving homeowner dies.

Your beneficiaries have 12 months after your death in which to repay your equity release plan.

This is usually from the sale of your property; although it can be by any financial means, if, for example your family wish to arrange a remortgage and settle the plan.

Once your equity release plan is repaid, the balance of money will then form part of your inheritance and your estate.