Equity Release Interest Rate Comparison: Unlock Your Wealth in 2024

Equity release comparison is key to finding the right solution for your specific needs.

Later Life Finance compare the whole market to help simplify the process for you.

Equity release comparison is key to finding the right solution for your specific needs.

Later Life Finance compare the whole market to help simplify the process for you.

Compare Equity Release With The Experts

Author Paul Murphy

Updated December 2023

As a specialist equity release broker, Later Life Finance are well positioned to provide an expert insight into equity release comparison.

We compare the best equity release companies and the top lifetime mortgage providers to help you select the right option for your requirements.

But how do you compare equity release options to get the right plan for your specific needs?

We provide a professional comparison and overview of the options currently available to homeowners, with in depth, side by side equity release scheme reviews to find out who are the best equity release companies.

Get your free comparison...

How Do You Compare Equity Release Rates?

Equity release interest rates are based on several factors, including the amount of money taken and the overall size of the facility required.

Pension and insurance firms are better suited to finance the equity release mortgages than large, well-known banks because the funding models required are based on a longer-term lifetime basis.

Our equity release guide helps answer some of the common questions about raising cash from your home.

We compare equity release interest rates from the whole market, including the providers Aviva, Royal London, Liverpool Victoria, Legal & General, More 2 Life, Canada Life, Just (formerly Just Retirement), One Family, Standard Life, Crown and Livemore.

This article provides insights into the following:

- Equity release comparison: We compare the top equity release deals and schemes for UK homeowners.

- Comparing equity release plan features, with essential factors to consider such as voluntary repayments, fees and helpful tips for comparing the most suitable equity release providers.

As members of the equity release council, Later Life Finance provide expert advice on releasing equity, and compare and review all equity release companies in the UK to find your best solution.

Here we compare the top 10 equity release companies and their schemes to help you find the right plan for you. Let’s get started!

I have known Paul for a number of years, and he is very professional & knowledgeable and always goes the extra mile for his client's. I would have no hesitation in recommending Paul to any potential clients requiring equity release. Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage.

Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage. Brian Bircham13/02/2024Very good

Brian Bircham13/02/2024Very good Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers!

Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers! Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance.

Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance. Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation.

Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation. Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted.

Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted. Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services.

Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services. Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw.

Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw. Jeffrey Wade07/01/2021

Jeffrey Wade07/01/2021

| Provider | Interest Rate | MER (Monthly) | AER (Annual) |

|---|---|---|---|

| ABC Equity Release | 3.25% | 0.27% | 3.32% |

| XYZ Equity Release | 3.50% | 0.30% | 3.55% |

| Provider | Interest Rate | MER (Monthly) | AER (Annual) |

|---|---|---|---|

| ABC Equity Release | 3.25% | 0.27% | 3.32% |

| XYZ Equity Release | 3.50% | 0.30% | 3.55% |

| Example Equity | 3.75% | 0.32% | 3.81% |

| Equity Master | 3.90% | 0.35% | 3.95% |

| Best Returns Equity | 4.00% | 0.38% | 4.06% |

| Secure Future Equity | 3.65% | 0.28% | 3.71% |

| Steady Growth Equity | 3.80% | 0.31% | 3.86% |

| Reliable Investments | 3.95% | 0.34% | 4.01% |

| Secure Horizon Equity | 3.60% | 0.25% | 3.66% |

| Golden Years Release | 4.10% | 0.40% | 4.16% |

| Provider | Interest Rate | MER (Monthly) | AER (Annual) |

|---|---|---|---|

| ABC Equity Release | 3.25% | 0.27% | 3.32% |

| XYZ Equity Release | 3.50% | 0.30% | 3.55% |

Comparing equity release companies: How to find the right solution

In order to help you in comparing the top equity release deals, we compare & review each lender side-by-side to help you research your options.

If you are considering how much can I borrow on a lifetime mortgage and who the best provider is, we assess factors such as equity release scheme flexibility, setup costs and exit fees for early repayment.

By doing so, we aim to help you avoid any companies that do not offer the features you require and determine the best provider for your needs.

For homeowners wondering is a lifetime mortgage is a good idea and how to choose a lender, we provide a complete broker service to source the correct solution for your requirements.

Is now a good time for equity release?

Is it a good time to release equity?

Our experts at Later Life Finance understand how lifetime mortgages work and the best way to arrange the plans to benefit you and preserve more of your equity.

When choosing the best equity release scheme for your needs it’s important to think not only about your current requirements, but also what’s important to you in the future.

For example, avoiding a substantial early repayment charge if you wish to settle the mortgage in the event of downsizing may be more important to you than other features such as the interest rate on the plan.

Areas to consider are:

1. Interest Rate (Monthly VS Annual Equivalent Rate)

2. Early Repayment Charges (And downsizing protection)

3. Voluntary Repayment Options- Payment frequency, method and flexibility

4. Rules on property type, flat roof, location, construction

Later Life Finance compare each lenders early repayment fees, as not every company and plan provides the same levels of flexibility for moving home.

Comparing and finding the best equity release company to match your specific needs is crucial, but which is the right equity release scheme for you?

Later Life Finance compare all equity release interest rates and deals and review all your options to ensure suitable advice.

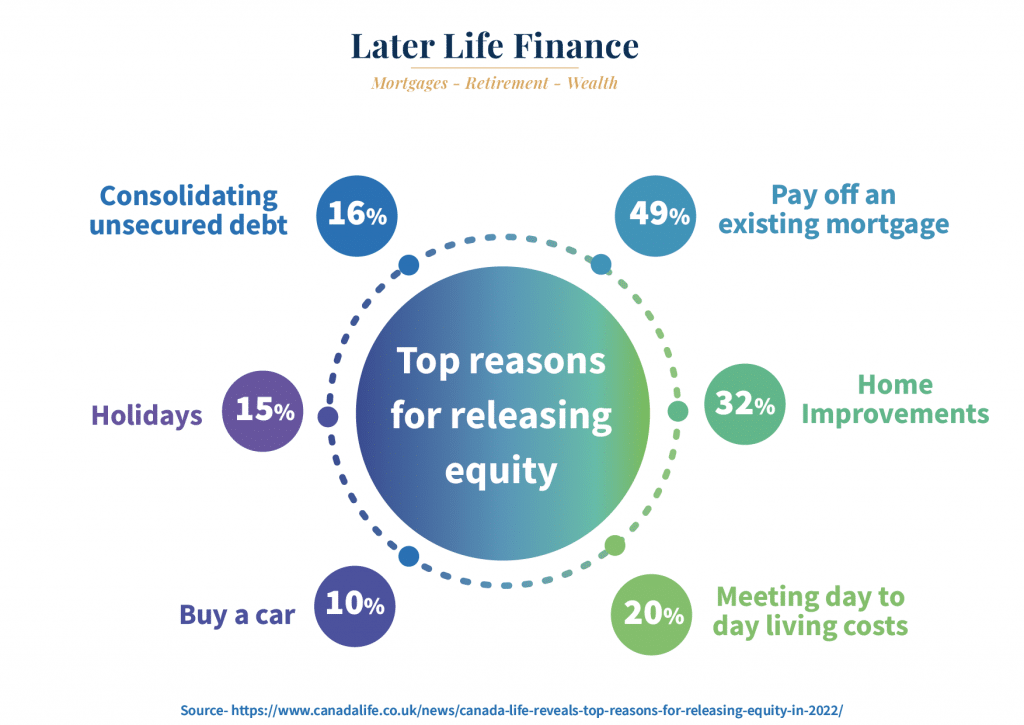

Demand is growing amongst over 55’s releasing equity for a cash boost to improve finances, raising funds for interest only remortgages, funding home improvements and gifting an early inheritance.

The rise in lifetime mortgage applications over the past 5 years is set to grow further with the increasing costs of living and the desire to enjoy a comfortable retirement.

It’s important to ensure that the solution you choose fits your current and longer-term priorities, such as whether you plan to move home or settle the mortgage early.

This is because providers have varying levels of options, features, and criteria. This makes the requirement for expert equity release advice even more necessary.

We review all your equity release later Life finance options to ensure you find the most suitable solution for your needs.

Ready to compare quotes? Book a free call back today to review your options

Top 12 Equity Release Comparison

Canada Life

Legal & General

Aviva

Nationwide

Just

LV=

Pure Retirement

Standard Life

Crown Equity Release

Livemore

More to Life

Canada Life Home Finance Compared

“We have 3.4 million customers, 470,000 pension annuities in force, and manage more than £42.2 billion of equities, fixed income and property”

Canada Life are an established equity release provider and offer flexible mortgages which allow you draw down money as and when you need it.

They have a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest. Up to 10% of the sum borrowed can be repaid per year.

They also offer a feature called downsizing protection, which offers added flexibility for moving home and settling the plan early.

They have fixed early repayment charges compared to many of the other lenders available.

Legal & General Home Finance Compared

“In June 1836, six lawyers founded Legal & General and our aim to build a better society has been present for as long as we have.

Today we help over 10 million people with savings, retirement and life insurance”

Legal & General offer two Defaqto 4-star rated lifetime mortgages. They offer flexible mortgages that allow you draw down money as and when you need it.

They offer a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest. Up to 10% of the sum borrowed can be repaid per year.

They also offer a retirement interest only mortgage (RIO), which does not offer the same level of protection as a lifetime mortgage, as there is a risk of repossession if the monthly repayments were defaulted on.

Legal & General offer defined exit fees starting at 10% in year 1 which reduces by 1% each year.

Aviva Compared

“We’re a composite insurer made up of separate business areas, covering everything from pensions to pet insurance”

Aviva offers a choice of two Defaqto 4-star rated lifetime mortgages.

They offer flexible mortgages that allow you draw down money as and when you need it.

They have a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest, up to 10% of the sum borrowed can be repaid per year.

Aviva offer defined exit fees starting at 10% in year 1 which reduces by 1% each year.

Nationwide Compared

“We’re a building society, or mutual, owned by our members. That’s anyone who banks, saves or has a mortgage with us”.

Technically Nationwide aren’t a lifetime mortgage lender. They provide mortgages with fixed monthly payments for later life borrowers, including a retirement interest only mortgage. They do not offer a drawdown option.

Their plans differ from a lifetime mortgage as the Nationwide require sufficient income to service the interest payments. The plans are not protected by Equity release council codes of conduct.

Just (JRL Group) Compared

“JRL started out by specialising in guaranteed income for life solutions (provided by pension annuities) and lifetime mortgages”

Just offer a lifetime mortgage that lets you release a one off lump sum or an initial lump sum and extra cash when you need it. They have flexible mortgages that allow you draw down money as and when you need it.

They offer a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest. Just also offer a medically enhanced lifetime mortgage.

Liverpool Victoria Compared

“From humble beginnings we’ve been going strong since 1843!”

LV= offer flexible equity release plans that allow you draw down money as and when you need it.

They offer a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest. Up to 10% of the sum borrowed can be repaid per year.

Liverpool Victoria have fixed early repayment charges compared to many of the other lenders available.

Pure Retirement Compared

“Established in 2014, Pure Retirement was the top of this year’s list of fastest growing businesses in Yorkshire”

Pure Retirement offer equity release plans and have flexible mortgages that allow you draw down money as and when you need it.

They offer a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest. Up to 10% of the sum borrowed can be repaid per year.

Pure Retirement have several plans with varying levels of exit criteria for early repayment.

Standard Life Compared

Standard Life is “a brand that has been trusted to look after people’s life savings and retirement needs for nearly 200 years”.

Standard Life offers two Defaqto 5-star rated lifetime mortgages. These plans are not available across the whole marketplace. Select brokers can arrange their mortgages.

Later Life finance are able to arrange Standard Life plans.

They offer flexible mortgages that allow you draw down money as and when you need it, and a repayment option that lets you repay some or all of the monthly interest to reduce the effect of compound interest.

Up to 10% of the sum borrowed can be repaid per year.

Standard Life have defined exit fees starting at 8% in year 1 which reduces each year.

Crown Compared

“Crown Equity Release is an independent specialist arranger of capital, it has been assisting clients on how to get the most out of their retirement Since 2001”

Crown are an equity release home reversion plan specialist.

A home reversion plan involves selling a share of your property, as opposed to a mortgage where you retain full home ownership.

This arrangement is more permanent than a lifetime mortgage and are difficult to reverse once they are arranged.

More 2 Life Compared

“More2life was founded, with big ambitions to change the equity release market by designing lifetime mortgages focussed on customers’ needs”

More 2 Life offer equity release plans include enhanced terms for certain medical issues, which could increase the level of lending available.

They offer flexible mortgages which allow you draw down money as and when you need it.

They have a flexible repayment option which allows some or all of the monthly interest to be repaid to help reduce the effect of compound interest.

Up to 10% of the sum borrowed can be repaid per year.

More 2 Life have several options with their early repayment charge criteria, most of which are fixed and defined.

Livemore Compared

"LiveMore was founded in in 2020 to solve a problem that many people aged 50-90+ in the UK face: accessing the mortgage options they need and deserve"

Providing retirement interest only and lifetime mortgages, Livemore are quickly gaining a reputation for efficiency and flexibility in the later life mortgage market.

Try our equity release calculator It’s completely free and there’s never any obligation to proceed with a solution.

Later Life Finance equity release comparison

Later Life Finance are technically a broker. We are passionate about providing expert equity release advice from the whole market on an independent basis. We have access to the best companies, plans and deals available and compare the whole market.

Get in touch with our experts on 0800 2465228 for advice on all your options.

Comparing the best equity release options for your plans

Discovering which equity release company is best for your specific requirements is crucial to ensuring you find the right solution for your current and longer-term plans.

Liverpool Victoria and Canada Life, for instance, offer ‘defined’ early repayment charge criteria for early settlement of the mortgage.

Canada Life also provides ‘downsizing protection’ for moving home and settling the mortgage early.

Other well-known names such as Standard Life and Legal & General offer plans with a wide range of features.

The overall market is competitive, with lenders frequently vying for the most competitive interest rate position.

Some lenders, like More 2 Life, Aviva, and Just, provide medically enhanced lending plans with higher loan-to-value percentages of lending based on health conditions.

When selecting an equity release plan, consider plan features such as the applicable interest rate, any early repayment charges, lender fees, inheritance protection features, and downsizing protection.

Expert advice is important when considering equity release options as lenders have varying levels of plan options, features, and criteria.

The equity release industry is regulated by the Financial Conduct Authority for consumer protection.

It’s not a ‘one size fits all’ approach with equity release companies.

Voluntary repayments & how to compare schemes

Voluntary repayments are a feature of all lifetime mortgages to make repayments toward the loan amount on a voluntary basis which can help you preserve more equity for inheritance or downsizing in the future, for example.

Here’s how voluntary repayments work in equity release:

Lifetime Mortgage Basis: Voluntary repayments are more commonly associated with lifetime mortgages, which are the most popular type of equity release product. With a lifetime mortgage, you borrow money secured against the value of your home, and the loan, including any interest accrued, is repaid when you pass away or move into long-term care.

Interest Roll-Up: By default, with a lifetime mortgage, the interest on the loan is typically rolled up, which means it is added to the outstanding balance over time. This can lead to the debt growing substantially over the years and reducing inheritance for your beneficiaries.

Flexibility: Some equity release plans offer the flexibility for homeowners to make voluntary repayments, which can include both interest payments and capital repayments of up to 10% of the sum borrowed per year. These repayments are made on top of the regular interest accruing on the loan.

Benefits of Voluntary Repayments:

- Reducing the balance owed: Voluntary repayments allow homeowners to reduce the overall debt that accumulates over time. This can help preserve more of the home’s equity for inheritance.

- Lower Interest Costs: By paying off some or all of the interest as it accrues, homeowners can prevent interest from compounding, leading to potentially lower overall costs.

- Flexibility: Borrowers can decide when and how much to repay. This flexibility can suit different financial situations and goals

How Later Life Finance can help you compare the whole equity release market

At Later Life Finance, we have 15 years of mortgage expertise and compare equity release plans, analyse interest rate costs, plan exit criteria, and other factors to ensure we identify the most suitable solution for you.

We have technical expertise in legal aspects, including property title splits, lease extensions, and trust cases.

Get in touch with one of our equity release advisers today to discuss your requirements.

Equity release has evolved into a viable, mainstream later life mortgage product.

With 40 thousand interest-only mortgages maturing per year over the coming decade*, a safe and flexible solution now exists for homeowners to remain in their homes if downsizing isn’t preferable, and to access tax-free equity for retirement, wealth distribution by gifting an early inheritance to family, for aspirational purposes, or simply to help homeowners meet the increasing costs of living.

Get in touch with an equity release adviser to discuss your requirements today.

*Source FCA interest only mortgage report

Comparing Home equity loan companies with bad credit?

Equity release with bad credit is possible when comparing several lifetime mortgage lenders.

Since equity release plans are not income and affordability based for lending purposes credit score is not a deciding factor when applying for the borrowing.

Get in touch with an equity release adviser to discuss your requirements today.

*Source FCA interest only mortgage report

Comparing equity release companies:Who is best to avoid?

It is sensible to avoid equity release providers that aren’t members of the Equity Release Council.

Dealing with a reputable Equity release council registered company and will ensure you access a reputable source for your requirements, as the council maintain several codes of conduct across the industry companies must follow for consumer protection.

The Equity Release Council protects you from the possible risks of equity release, including a no negative equity guarantee.

Dealing with companies who are regulated by the Financial Conduct Authority will also ensure the advice provided is regulated. This is a standard requirement across the lifetime mortgage market as the products are fully regulated by the FCA.

Comparison Of Equity Release Companies For Your Plans

The alternative options to releasing equity including moving home and considering using alternative assets. Any potential entitlements to means tested benefits will also be discussed.

Once all your questions have been answered and if suitability for equity release is established, our experts specialise in finding the best providers to meet your needs.

Reviewing the best equity release companies for your requirements will ensure the most suitable solution is found.

Our professional experts are qualified to provide advice on all your options. Your free consultation can be carried out over the phone or via video call for your convenience.

Comparing Equity Release Provider Arrangement Fees

When comparing companies, there are several fees to consider when releasing equity from your home.

Your adviser will provide a detailed illustration and explain what fees apply, why, and how they are best paid to help minimise the interest costs on the mortgage.

For example, you may prefer to pay the fees separately, as adding these to the mortgage can increase the level of interest repaid on the mortgage.

Application fees Comparison

Certain lifetime mortgages have application fees, which are normally around £500.

If you add them to the loan, interest will be charged on them. Some lenders allow you to pay these separately.

Mortgages with an application fee and lower interest rate may be more cost effective for people borrowing larger sums. For people borrowing smaller sums a ‘fee free’ plan with a higher rate may be more suitable.

The difference in interest rates is normally around 0.25% between the fee paid and fee free options.

Some lenders charge a transfer fee of around £35 to send the money to your solicitor when the money is paid to you.

Early repayment charges Comparison

All equity release companies have early-repayment charges, although lenders have streamlined the products over the past 10 years to add flexibility when repaying early.

Many lenders have fixed early-repayment charges which reduce down to zero over 10-15 years.

Downsizing protection is a feature to protect you when moving home and repaying the mortgage early, and is worth considering if you plan to move home and settle.

Your adviser will provide a key facts illustration detailing the specific early repayment charges.

Redemption fee Comparison

This only applies when the mortgage is finally repaid when you die or move into long-term care (on the last survivor leaving the property in joint cases).

Some firms charge a redemption fee of around £200, whilst some don’t apply this fee at all.

Adding or removing a name to the loan

If you divorce or remarried and add or remove someone to or from the equity release plan this would incur a legal fee.

Allowing around £700 plus VAT for this would be the typical cost in 2023.

Valuation fee

Most equity release lenders do not charge any valuation fees when the plan is arranged. For further advances expect to pay a valuation fee if your home needs revaluing in the event of applying for more money.

6. Solicitors fee

You do need a solicitor if you are releasing money from your home. Your adviser can normally recommend an independent firm, or you can choose your own. Your solicitor ensures the Equity Release Council legal standards are met and receives your funds from the lender to pay into your bank account on completion.

Legal costs for equity release vary from £750 upwards depending on the firm.

Calculate Your Equity- Our equity release calculator gives INSTANT RESULTS.

The Equity Release Council: Selecting Members Who Meet Your Needs

Firstly, all reputable equity release companies are members of the equity release council and regulated by the Financial Conduct Authority, the industry regulator and watchdog.

Equity Release Council membership verifies the firm you are dealing is reputable and adheres to the principles set out by the council.

Most lifetime mortgages allow voluntary repayments for flexibility and without any commitment. This means you can still service the interest without the same level of risk as a typical mortgage.

What are the codes of conduct the Equity release council require to be followed?

For lifetime mortgages the rate must be fixed for each release or, if variable, the rate must be capped for the life of the loan. (Most plans offer lifetime-fixed interest rates)

You must have the right to remain in your property for life or until you need to move into long-term care, provided the property remains your main residence and you abide by the terms and conditions of your contract.

You have the right to move to another property subject to the new property being acceptable to your product provider as continuing security for your equity release loan.

- The product must have a “no negative equity guarantee”. This means that when your property is sold, and agents’ and solicitors’ fees have been paid, even if the amount left is not enough to repay the outstanding loan to your provider, neither you nor your estate will be liable to pay any more.

- All customers taking out new plans which meet the Equity Release Council standards must have the right to make penalty free payments, subject to lending criteria.

The industry is also governed by Financial Conduct Authority (FCA) regulation.

Comparing Equity Release Providers Near You

To ensure you can access the full range of plans from the best equity release company for your needs, Later Life Finance provide expert equity release advice nationwide via telephone, video and home appointments.

Independent advice on all options, alternatives, and potential impact on means tested state benefits is crucial before releasing equity. Your equity release company will take into consideration your circumstances, objectives, and help determine if a lump sum or a drawdown lifetime mortgage is suitable.

We will establish suitability, your attitude to risk, and inheritance preferences. We will also explain each form of equity release, including lifetime mortgages and home reversion plans, and the factors to consider such as interest rates and early repayment charges.

Comparing Equity Release Companies: How To Tackle Compound Interest

Obtaining expert advice to navigate the various pros and cons of each lender is crucial to specify who the best equity release company is, based on your specific needs and objectives.

The main downside of equity release is compound interest; however, most lenders allow voluntary repayments to be made, meaning this negative factor can now be reduced or even eliminated entirely by arranging regular repayments to the mortgage to avoid compound interest.

A compound interest illustration will be provided by your adviser. A compound interest calculator can also be used to factor in any planned voluntary repayments with the projection of interest over the term of the mortgage (the true term being on a lifetime basis) to help show the benefit of making repayments if you plan to exercise this facility.

Remember, this option is purely voluntary and if preserving your equity for an inheritance, downsizing or for long term care is not a priority, the interest can be ‘rolled up’ onto the sum borrowed and settled at the end of your lifetime when the property is sold.

Understanding all your options is key to deciding which equity release company is correct for your specific circumstances, and knowing which companies to avoid to ensure you source the best solution is equally important.

Access to a qualified equity release adviser who are Equity Release Council registered will ensure you receive independent, expert advice.

Later Life Finance are members of the equity release council. To book an appointment with an expert without any obligation click here

Dealing with an adviser with access to the whole equity release market will enable you to access the best equity release companies and schemes available, which will help match your requirements with the most appropriate solution available when comparing the equity release schemes your needs on an impartial basis.

Get your free comparison...