Equity Release and Inheritance Tax: Preserving Your Wealth in 2024

Can you use equity release to avoid inheritance tax?

A lifetime mortgage is deducted from your estate on death and can be used to reduce your IHT bill.

Equity Release and Inheritance Tax: Preserving Your Wealth

Can I use equity release to avoid inheritance tax? A lifetime mortgage is deducted from your estate on death and can be used to reduce your IHT bill, if used correctly.

Our expert guide will help with your research.

Later Life Finance

Author Paul Murphy. Updated January 2024

Recent significant property inflation has seen many homeowners being caught in the ‘inheritance tax trap’, but can you avoid this with forward planning to preserve your wealth?

Families only have 6 months to settle when IH is due payable, which also comes as a surprise for many people, and avoiding this level of pressure to pay a potentially large tax bill is attractive.

Equity Release lifetime mortgages provide access to tax-free cash, which can be spent and gifted outside of your estate to help reduce your Inheritance Tax (IHT) bill.

On death, your IHT liability is calculated from your assets, minus your liabilities.

The seven-year rule for inheritance tax purposes is also a prime consideration for gifting lump sums. A pragmatic approach with early stage planning is crucial; ‘the earlier the better’ strategy is logical if you wish to release equity to gift.

Avoiding inheritance tax is concern for an increasing number of families. We explore how equity release can be used to extract the wealth in your home.

Equity release can reduce the value of your estate and potentially decrease or even eliminate the inheritance tax bill. By lowering the value of the estate, you may minimise the amount of inheritance tax payable, allowing your beneficiaries to inherit more of your assets.

Get Your Free Calculation & our guide straight to your inbox

How do lifetime mortgages affect inheritance tax?

When taking out a lifetime mortgage, you are using the equity in your home as security for the money you borrow. This has the effect of reducing the value of your estate by the original amount of the lifetime mortgage, plus any interest and charges.

Equity release allows homeowners to access the value of their property without selling it, providing a source of tax-free cash for retirement planning, home improvements and gifting an early IH, for example.

By learning about the various strategies available, you can optimise your inheritance tax planning with equity release to secure a brighter financial future for yourself and your loved ones.

Let’s dive into the concept of how equity release influences IH tax to gain a better understanding of the financial tools available to homeowners with estate, wealth and inheritance tax planning.

Inheritance tax owed is due within six months of the death of the last surviving homeowner.

The tax is calculated based on the estate value, any gifts made by the deceased in the seven years prior to their death and any applicable exemptions or reliefs.

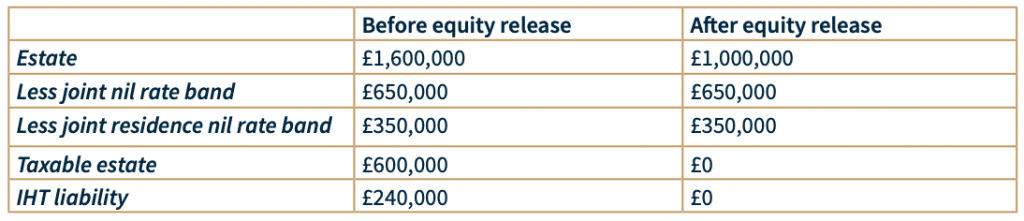

Inheritance tax is imposed on the value of an estate upon the death of an individual. The executor of the estate is responsible for paying this tax before any assets are distributed to the beneficiaries. In the UK, the current inheritance tax threshold for each spouse or partner is £325,000, with a joint residence nil rate band of £175,000.

Gifting money to family members before death can result in a reduction of the total value of the estate, potentially bringing it below the applicable allowance thresholds. This can provide a direct or indirect benefit to the family members receiving the gift and reduce IH tax, as long as the person making the gift remains alive for more than seven years.

Understanding how inheritance tax works and its implications on your estate is crucial for effective estate planning.

By having a clear picture of your potential inheritance tax bill, you can take appropriate steps to minimise the liability and ensure your beneficiaries’ inheritance tax bill is minimised. Being aware of your inheritance tax obligations will help you make informed decisions for your estate.

Equity release can have a significant impact on inheritance tax, and it’s important to understand how equity release affects inheritance. By reducing the value of your estate through equity release, you may decrease or even eliminate the inheritance tax bill for your beneficiaries. Furthermore, gifting cash from equity release to a designated beneficiary of the will and surviving for more than seven years after making the gift can result in the gifted funds being exempt from inheritance tax.

However, it’s essential to consider the potential implications of equity release and inheritance tax on your family’s financial future. Communication and family involvement are crucial to ensuring all parties understand the situation and make informed decisions that are in their best interests.

One way to reduce inheritance tax is by gifting money from equity release to family members. This strategy allows you to make use of the annual tax-free gifting allowance and the seven-year rule, which can help lower the inheritance tax for the recipients of your gifts. However, it’s essential to understand the rules and limitations surrounding tax-free gifting and the seven-year rule in order to effectively use this strategy and avoid potential pitfalls.

By gifting fund from equity release to your loved ones, you can not only provide financial support during your lifetime, but also potentially reduce the amount of inheritance tax they’ll need to pay upon your passing. But it’s crucial to be aware of the risks involved, as it’s impossible to predict how long you will live after making the financial gift, which may impact the tax implications of the gift.

The annual tax-free gifting allowance is a valuable tool for those looking to minimise inheritance tax. Under this allowance, you can gift up to £3,000 per year without incurring inheritance tax. The annual tax-free gifting allowance provides a straightforward way to reduce your estate’s value and, consequently, the potential inheritance tax bill for your beneficiaries.

By making regular gifts up to the annual tax-free gifting allowance, you can provide financial support to your loved ones during your lifetime while also reducing your estate’s value for inheritance tax purposes. It’s a win-win situation that benefits both you and your beneficiaries.

The seven-year rule is another essential aspect of inheritance tax planning when it comes to gifting money from equity release. Under this rule, if you give away assets and live for at least seven years after making the gift, it becomes completely tax-free. However, if you pass away within seven years of making the gift, it may be subject to inheritance tax, depending on the value of the gift and the time elapsed since it was given. If you pass away within 7 years of making the gift, the tax due is calculated using a taper relief scale.

Understanding and utilising the seven-year rule can help you strategically plan your gifts to minimise the inheritance tax bill for your beneficiaries. By timing gifts appropriately and taking advantage of this rule, you can ensure that your loved ones receive the maximum possible inheritance without being burdened by a hefty tax bill.

Lifetime mortgages, a popular form of equity release, can be used strategically to minimise IHT through careful planning and gifting. By borrowing money against the value of your home through a lifetime mortgage, you can access the equity needed to make gifts that reduce your estate’s value and, consequently, your inheritance tax bill.

For example, let’s say you take out a lifetime mortgage and use the funds to make a series of gifts to your beneficiaries within the annual tax-free gifting allowance and in accordance with the seven-year rule. By doing so, you can effectively reduce your estate’s value and minimise the inheritance tax bill for your loved ones while still retaining ownership of your home.

You can also use the funds from equity release as part of your retirement planning strategy, for holidays, lifestyle and leisure purposes. Funds can be taken on a drawdown basis to reduce the effect of interest charged on the mortgage.

IH protection in equity release is a feature that allows homeowners to guarantee a certain percentage of their property’s value for their beneficiaries, even if the sale price doesn’t cover the entire loan amount. This protection can provide peace of mind for those who want to ensure that their loved ones will receive a portion of the property’s value, regardless of the outstanding mortgage balance and interest at the time of their passing.

However, it’s important to note that removing inheritance protection from an equity release plan can lower the amount that can be borrowed through equity release. This trade-off should be carefully considered when deciding whether to include IH protection in your equity release plan, as it can impact the overall benefits of the plan for you and your beneficiaries.

Inheriting a property with equity release comes with its own set of challenges for the executor of the estate and the beneficiaries. The executor is responsible for repaying the lifetime mortgage and interest on the property, which may require selling the house to cover the debt. This means that the beneficiaries may not receive the full value of the property, as the outstanding mortgage balance and interest must be paid first.

It’s crucial for those considering equity release to discuss their plans with their beneficiaries and consider the potential implications of inheriting a property with equity release. By having an open dialogue and understanding the potential challenges involved, both parties can make informed decisions about how to best manage the property and its associated debts upon inheritance.

When considering equity release and inheritance tax planning, it’s crucial to seek professional advice from financial advisers and estate planners. These professionals can provide personalised guidance based on your unique circumstances, helping you make informed decisions about how to best manage your estate and minimise your inheritance tax bill.

Later Life Finance provides access to lifetime mortgages from the whole marketplace of providers, offering a completely free service unless you decide to go ahead with a plan. By seeking professional advice, you can ensure that you’re making the best possible decisions for your estate planning and securing a brighter financial future for your loved ones.

Gifting cash from equity release to family members can potentially reduce inheritance tax. If the person making the gift survives for more than seven years after making the gift, the funds will not be subject to inheritance tax. The tax won’t be calculated in the same manner as before. Instead, it will be calculated using the reducing scale known as ‘taper relief’.

This strategy can be an effective way to provide financial support to your loved ones while also reducing the overall value of your estate for inheritance tax purposes. However, it is important to consider the potential effects of gifting equity release funds on your own financial situation and the future financial security of your beneficiaries.

Inheritance tax planning with equity release involves various strategies that can help optimise your financial future and minimise the inheritance tax bill for your beneficiaries. By utilising equity release in a strategic manner, such as through lifetime mortgages or inheritance protection options, you can secure a brighter financial future for both yourself and your loved ones.

It is important to consider your future plans and the specific features of each equity release plan when embarking on inheritance tax planning with equity release. By working with a qualified financial adviser and involving your family in the decision-making process, you can ensure that your chosen strategy aligns with your financial goals and the best interests of your beneficiaries.

Understanding the relationship between equity release and inheritance tax is crucial for optimizing your financial future and the inheritance you leave behind. By exploring various strategies such as lifetime mortgages, inheritance protection options, and gifting equity release funds, you can make informed decisions that benefit both you and your loved ones. Communication and family involvement are essential to ensure that all parties understand the implications of equity release and make informed decisions that align with their best interests. By navigating inheritance tax obligations and seeking professional advice, you can take control of your financial future and secure a brighter financial future for yourself and your loved ones.

When considering how equity release will affect inheritance tax, gifting and transferring property wealth with a lifetime mortgage and the associated tax planning advantages is an increasing area of interest for homeowners to reduce the impact of this tax upon their families.

Enjoying the benefits of gifting equity release funds whilst still alive and reducing the tax implications provides an attractive concept for homeowners.

The house price gap with younger people effectively being ‘priced out’ of the market also makes a strong case for utilising equity to assist families with home deposits- or other gestures, such as funding grandchildren’s education fees.

Equity release and inheritance tax

What's the best way to reduce inheritance tax?

Gifting money to family is a popular way of reducing the amount of tax payable. Equity release with a lifetime mortgage is a common method of raising equity to gift to family members.

Gifting an early inheritance can be done via special mortgages which give you the power to safely unlock tax-free equity from your home. Repayments are optional and home ownership is retained for life.

The benefits of gifting cash by utilising the wealth in your home can be used to distribute funds to your family. This can also form part of your tax plan for the future.

If you make a gift and survive for 7 years or more, the gift can be tax-free, making this gesture a popular method of distributing and preserving your hard-earned wealth.

How can equity release save inheritance tax?

By reducing the size of your estate when you pass away, equity release provides a method of raising cash from your home without downsizing to spend as you wish.

As the money borrowed plus interest is deducted from your estate upon death or long term care, this helps reduce any tax due payable.

How does equity release affect inheritance?

Raising money from your home will reduce the amount of inheritance as the equity release is repaid from the sale of your home when you pass away or go into long term care.

Homeowners are increasingly gifting an early inheritance with money from equity release funds raised to enjoy the benefits of gifting and receiving whilst they are still able to.

Is Equity Release a Good Idea To Avoid Inheritance Tax?

Releasing equity is a popular way of reducing the amount of IH tax payable as it decreases the size of your estate when you pass away. Avoiding inheritance tax completely will rely on various factors, however Equity release via a lifetime mortgage is a common method of raising cash from property whilst you are alive.

How does equity release affect probate?

Equity release is due to be repaid within 12 months of the last surviving homeowner passing away or going into long term care.

Firstly your beneficiaries will need to contact your lender and provide a copy of the death certificate and probate document in order to communicate with the executors of your estate.

The executors of your estate will have control over marketing the property with an estate agent. When the property is sold, the outstanding balance owing is settled and after any professional fees such as legal costs are settled the residual balance will be paid to your estate.

How does equity release work when someone dies?

Equity release is repaid within 12 months of the last surviving homeowner passing away or going into long term care. On first death or long term care, the plan continues until the surviving homeowner passes away or goes into long term care. Then the property is sold and the plan is settled.

Equity Release & Inheritance tax -

Your Questions Answered

Is Equity Release Tax Free?

Equity release is free from tax and not subject to Income Tax as it is not a form of income, as it is a mortgage. Since the lending is taken out against your home, this is not taxable for income or capital gains tax.

Even if you are planning to Release Equity to supplement your income, you are not subject to any taxation on the money released.

Is Equity Release Subject to Inheritance Tax?

Equity release is an option for older homeowners to consider if distributing the wealth built up in their homes to family is a consideration, however understanding how equity release affects the impact of tax due is important to clarify the overall implications.

For many people their home will form most of their estate, which ultimately makes this an important decision to make.

Do You Have To Pay Inheritance Tax on Gifted Money?

When gifting money from releasing equity, the money will not be taxed if you survive for seven years and don’t receive direct or indirect benefit back.

However, if you die within 7 years of gifting the funds, it will be brought back in to account with the rest of your estate when calculating the tax.

What Inheritance Tax Rules Apply if you are Married?

Specific rules apply for married couples or those in civil partnerships:

When you die, assets left to your spouse or registered civil partner are exempt from inheritance tax, provided they’re living in the UK.

In addition to this, your partner’s inheritance tax allowance rises by the percentage of your allowance that you didn’t use, therefore a a couple can currently leave £1 million tax-free (2 x £325,000 tax-free allowances + 2 x £175,000 main residence allowances).

What is The Inheritance Tax Threshold?

Inheritance tax is a tax due on the estate of someone who’s died.

The amount of tax due depends on the value of the deceased’s estate – which is worked out based on their assets (cash in the bank, investments, property or business, vehicles, payouts from life insurance policies), minus any debts including mortgages and equity released from their home.

There is normally no IH tax to pay if:

The total value of your estate is below £325,000, OR

You leave everything over £325,000 to your spouse, civil partner, a charity or an amateur sports club

If neither of the above apply, your estate will be taxed at 40% on anything above the £325,000 threshold when you die (36% if you have left at least 10% of the value after any deductions to a charity in your will).

What is The Impact Of Equity Release on Inheritance Tax?

When releasing equity from your home to gift funds, the money is due repayable on the last death (or long term care) of the homeowner, therefore any money gifted is deducted from the sale of the property and the estate.

The equity raised from the sale of the property is used to repay the equity loan and reduces the inheritance so this money is not liable for tax calculation purposes.

How Does The Seven Year Inheritance Tax Rule Work?

When gifting from releasing equity, the money will not be taxed for inheritance tax purposes if you survive for seven years and don’t derive any direct or indirect benefit back.

This is referred to as the ‘7 year rule’. If you die within 7 years of making a gift and there’s Inheritance Tax due on it, the amount of tax payable after your death depends on when you gave it.

If you die within the next seven years, the money gifted will be taken into account when calculating how much tax is payable by your estate.

No tax is due on any gifts you give if you live for 7 years after making the gift, unless the gift forms part of a trust.

A ‘taper relief’ is applied between 3-7 years of making the gift.

Our calculator provides figures on how much equity you may be able to raise.