How much could you borrow with a lifetime mortgage?

Discover how much tax-free wealth you can unlock...

How Much Can I Borrow on a Lifetime Mortgage?

With a lifetime mortgage, the amount you can borrow is typically a percentage of your home's value, generally ranging from around 29.6% to 58.4%. This percentage varies based on your age and the specific terms offered by the lender.

Ready to explore your options further? For equity release advice you can rely on, get in touch for a free review and access to exclusive plans!

Author Paul Murphy

Later Life Finance Limited.

How much can you borrow with a lifetime mortgage?

The amount you can borrow is typically a percentage of your home’s value, generally ranging from around 29.6% to 58.4%. This percentage varies based on your age, property type and lender criteria.

If you’re considering releasing some of the equity in your home, knowing how much money you can borrow with a lifetime mortgage broker is one important factor, but understanding the most cost effective way to arrange the plan is equally important.

Our experts at Later Life Finance will calculate how much you can borrow on a lifetime mortgage with voluntary interest payments included.

For example, if you can budget a monthly payment of £100, we will provide detailed graphs and projections showing the effect of compound interest and the benefits of making your chosen payments.

With a lifetime mortgage, the amount you can borrow is typically a percentage of your home's value, generally ranging from around 29.6% to 58.4%. This percentage varies based on your age and the specific terms offered by the lender.

Lifetime mortgage calculator: How to calculate the best deals

Our lifetime mortgage calculator is a great way to get started with calculating the percentages of equity available. We have access to exclusive interest-only lifetime mortgage deals and discounted interest rates to save you money.

A drawdown lifetime mortgage can provide a much more economical method of accessing equity than a lump sum plan.

The growing range of equity release interest only lifetime mortgages are proving popular with homeowners seeking to retain control of their equity. Making regular payments enables you to avoid compound interest and preserve more wealth in your home for the future.

Arranging voluntary repayments based on your preferred budget can not only transform your finances, it can help preserve more equity for the future.

How much can you borrow with a lifetime mortgage maximum calculator?

Get started with our maximum lifetime mortgage calculator to provide an idea of your borrowing options, and book a free review with your expert adviser to compare the top deals available in the market.

We compare the top lifetime mortgage percentage options available and will calculate the best deal for you based on your requirements.

How to calculate the maximum equity release options

The maximum equity release available is based on the age of the youngest applicant. Some lenders offer lower percentages for joint applications compared to single applications.

However a married couple would in most circumstances be better to apply on a joint basis. This is because the plan is only due repayable on last death, or going into long term care.

Ready to compare deals with your expert adviser?

Best Rate Guarantee

Access broker exclusive deals

Lock in the best rates

Access lender cash backs

Claim your FREE home valuation

Book a no obligation FREE review today!

An example projection of interest costs with selected monthly repayments included

Interest only lifetime mortgage calculator

Arranging voluntary repayments based on your preferred budget can not only transform your finances, it can help preserve more equity for the future.

Our interest only lifetime mortgage calculator will help you understand the benefits of making regular repayments to your mortgage.

Arranging a lifetime mortgage is a big step, which takes careful research and planning to ensure the selected route is suitable both in the current the longer-term when calculating how much equity you can release from your home.

Later Life Finance have access to the full range of lifetime mortgage providers to establish how much you can borrow and the best solution for your requirements.

Dealing with genuine experts will help avoid pitfalls later down the line. We are often asked how long does equity release take to arrange.

This is around 6-8 weeks, but the company you choose to arrange your plan can also make a big difference to the overall experience and the timescales to arrange.

Fully understanding the pros and cons of each option in order to make a balanced decision is one of the most important parts of the process when considering who the best equity release provider is for your requirements.

What Is the highest LTV equity release?

Equity Release LTV Ratio

- LTV Definition: The Loan-to-Value (LTV) ratio in equity release is the percentage of your property’s value you can borrow.

- Typical Range: Most equity release customers can borrow between 20-60% of their home’s value through a lifetime mortgage.

- Factors affecting LTV: Age, property value, lender criteria, health and lifestyle

Is Equity Release Capped?

The maximum Loan-to-Value (LTV) percentage for a lifetime mortgage in the UK is typically capped at around 58.4%, although this can vary between providers.

What are the typical percentages available with equity release?

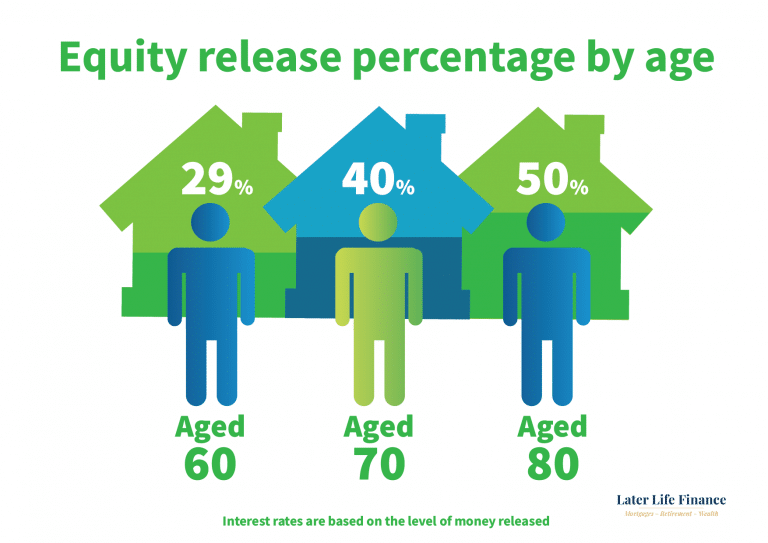

Equity release percentage by age

The percentage of equity a homeowner can release typically increases with age. While specific figures vary between lenders, here’s a general guide:

| 55 years old: | Around 20-25% of the property’s value can be released |

| 65 years old: | About 30-35% of the property’s value |

| 75 years old: | 40% or more of the property’s value |

| 85+ years old: | Up to 55% of the property’s value |

Our lifetime mortgage calculator is free and provides instant results. As experts in Later Life Mortgages and equity release, later life finance are well positioned to answer this and all your other questions.

You may be wondering if lifetime mortgages are a good idea and if they are suitable for your needs.

To compare the top 10 equity release companies, we have reviewed and listed the best providers to help you compare your options, including lender features, such as downsizing protection, voluntary repayments and more.

How much equity can i release from my home, and what can you borrow the cash for?

Help family with a gift

Dream Holiday

Cash Lump Sum

Pay Off your Mortgage

- Lifetime mortgages allow homeowners over 55 to borrow against your home with the option to make voluntary repayments to preserve more of your equity. (Payments are optional).

- No income or affordability checks to qualify, and takes around 8 weeks to arrange a lifetime mortgage. We have access to the best UK equity release companies to help the process run smoothly with expertise and service.

- The money is repaid at the end of your lifetime from the sale of your home.

- To check your eligibility and how much equity you can release, try our free equity release calculator

- Borrow between 20% and 50% of your home’s value, depending on age; enhanced mortgages available for those health problems.

- Negative equity guarantee for Equity Release Council members, which ensures you and your estate are fully protected. Martin Lewis mentions this when recommending how to safely choose a lifetime mortgage provider.

- Possible to move home and take the lifetime mortgage if moving to a suitable property

- Drawdown plans available to stage the borrowing over the coming years, providing more flexibility

- Get professional advice to understand if a lifetime mortgage is suitable.

What percentage can you borrow on equity release?

The percentage of your home’s value you can borrow using a lifetime mortgage is based on the youngest homeowner’s age and is usually between 20% and 55%.

For example, a single homeowner aged 55 could release up to 55%.

Mortgages for older borrowers include lifetime and retirement interest only schemes, and provide a greater range of solutions for older homeowners.

Later Life Finance provide advice on all equity release schemes to help you understand all your options when understanding how much equity you can release from your home.

If you’ve already arranged an equity release plan, you may be considering whether you can borrow more on a lifetime mortgage. Our lifetime mortgage calculator requires no personal details.

It’s possible to arrange additional funds via a drawdown facility or a further advance. If you have used your drawdown facility and need a further advance, contact us for help and we will explore this for you.

Lenders typically assess the value of your property through a professional surveyor appointed by them.

How much can I borrow on a lifetime interest only mortgage?

Typically, you can borrow between 20% and 60% of your property’s value. The exact amount depends on your age, property value, health, lifestyle, property type, and the lender’s criteria (Loan-to-Value or LTV).

What factors affect how much I can borrow with a lifetime interest-only mortgage?

Key factors include: Your age (youngest homeowner), your home’s value, your health and lifestyle, the type of home you own (freehold/leasehold), and the specific lending criteria of the mortgage provider.

How does a lifetime mortgage work?

Lifetime mortgages enable homeowners to borrow a portion of their property’s value, with interest accruing over time and repaid upon death or moving into long-term care.

If no voluntary repayments are made, the compounding interest can grow rapidly, so it’s essential to be aware of the total amount that will need to be repaid in the future.

Using an equity release compound interest calculator lets uk homeowners decide whether a lifetime mortgage is a suitable option to consider.

Later Life Finance provide detailed compound interest projections based on any repayments you plan to make.

Drawdown lifetime mortgages allow you to stage the borrowing over a longer timeframe which reduces the amount of interest charged on the money borrowed.

How long does a lifetime mortgage take to arrange?

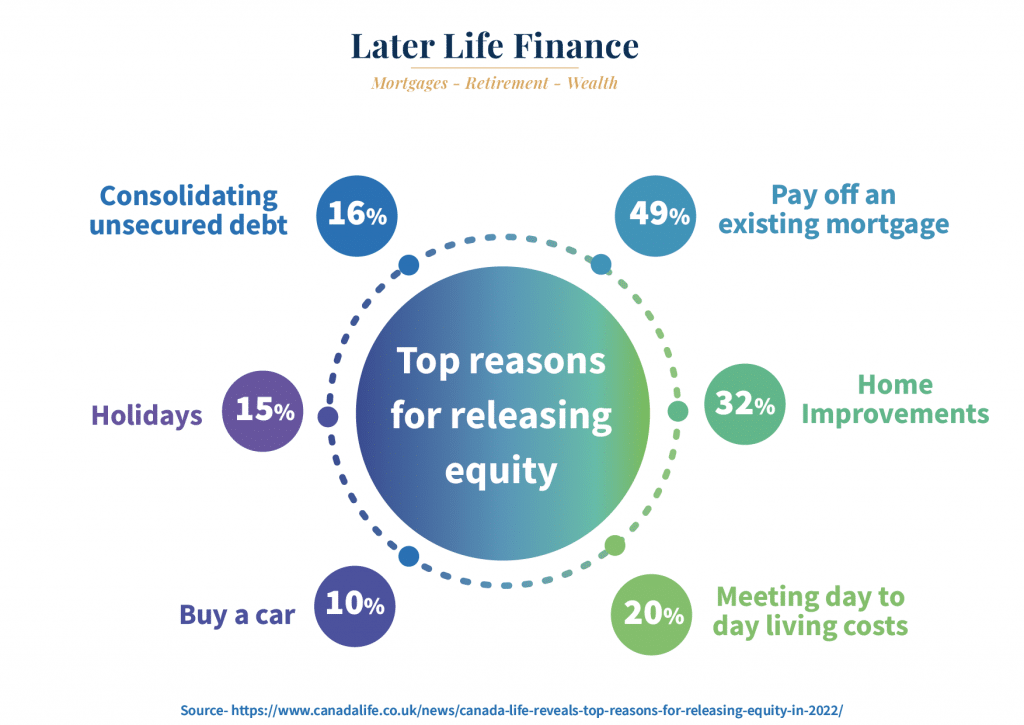

The most popular reasons for using lifetime mortgages

What is the maximum home equity loan amount?

The maximum home equity amount homeowner can release typically increases with age. Here’s a general guide:

| 55 years old: | Around 20-25% of the property’s value can be released |

| 65 years old: | About 30-35% of the property’s value |

| 75 years old: | 40% or more of the property’s value |

| 85+ years old: | Up to 55% of the property’s value |

Our lifetime mortgage calculator is free and provides instant results. As experts in Later Life Mortgages and equity release, later life finance are well positioned to answer this and all your other questions.

You may be wondering if lifetime mortgages are a good idea and if they are suitable for your needs.

To compare the top 10 equity release companies, we have reviewed and listed the best providers to help you compare your options, including lender features, such as downsizing protection, voluntary repayments and more.

How to calculate a lifetime mortgage, and what is the maximum loan to value of cash available?

There are a few factors that affect how much equity you could release from your home with a lifetime mortgage.

It’s important to remember each lender has different criteria.

As a guide, the following information is used to calculate how much money you could release.

The factors used to calculate this are:

- Your age (or the age of the youngest person if you own the property jointly)

- The type of home you own (house/flat)

- Your home’s valuation (lenders carry out a valuation)

- Your health and lifestyle

- Whether you have a leasehold on the property

- How you arrange your lifetime mortgage (as one cash lump sum, or a lump sum with a cash reserve facility)

- Choosing a lenders inheritance guarantee to leave a set percentage of your home’s value behind

Get your free lifetime mortgage calculation & book your free review...

Do you pay monthly for a lifetime mortgage?

You don’t have to make any regular payments with a lifetime mortgage.

You are entitled to make regular voluntary repayments to maintain control of the interest.

For example, if you want to avoid compound interest accruing, you could pay the interest back each month.

If you choose to do this, there will be no compound interest applied, so long as you continue to make these payments.

Can you be refused a lifetime mortgage?

What are the different types of lifetime mortgages?

When must the lifetime mortgage be repaid?

Who offers the best lifetime mortgage?

- LV=

- Legal and General

- LiveMore

- More2Life

- OneFamily

- Pure Retirement

- Scottish Widows

- Standard Life.

- Royal London

- Canada Life

- Aviva

- Just

What are the pitfalls of a lifetime mortgage?

What are the pitfalls of a lifetime mortgage to consider?

- A lifetime mortgage (unlike a regular mortgage) charges compound interest. This means If you don’t choose to repay the interest at regular intervals, the sum will compound and grow. This means at around 5 per cent interest, the amount you owe would double every 15 years due to the compound interest

- Means tested benefits- It’s crucial to check entitlement to any means tested benefits as these can be affected by having cash raised from a lifetime mortgage

- Inheritance-The amount you leave your beneficiaries will be reduced. This depends on whether you make voluntary repayments or not, and whether you take the cash as a large lump sum or drawdown payments.

Summary

Our free equity release calculator provides instant results. In order to provide you with an accurate calculation your age and estimated property value are required.

Any personal details provided are confidential and not shared with third parties.

Our expert equity release advisers will provide detailed interest projections and illustrations for your consideration.

Your adviser will check if an equity release product is suitable and explain how much equity you are eligible for and compare the market to ensure you secure the best solution.

They will also explain how the lifetime mortgage interest may affect the remaining equity in your home and they should recommend you discuss your plans with any family members, if appropriate.

To find out how much equity you can borrow with a lifetime mortgage, request a call back for a detailed illustration.