Equity Release Calculator

How Much Equity Can I Release in 2024?

Equity Release Calculator: How Much Equity Can You Release?

How much equity can I release in 2024?

Get your free calculation...

Registered providers

Updated January 2024

How much equity can you release from your home?

If you’re considering how much equity you could get from your home, it depends on various factors such as property type, health and income (which is used for the new interest only lifetime mortgages).

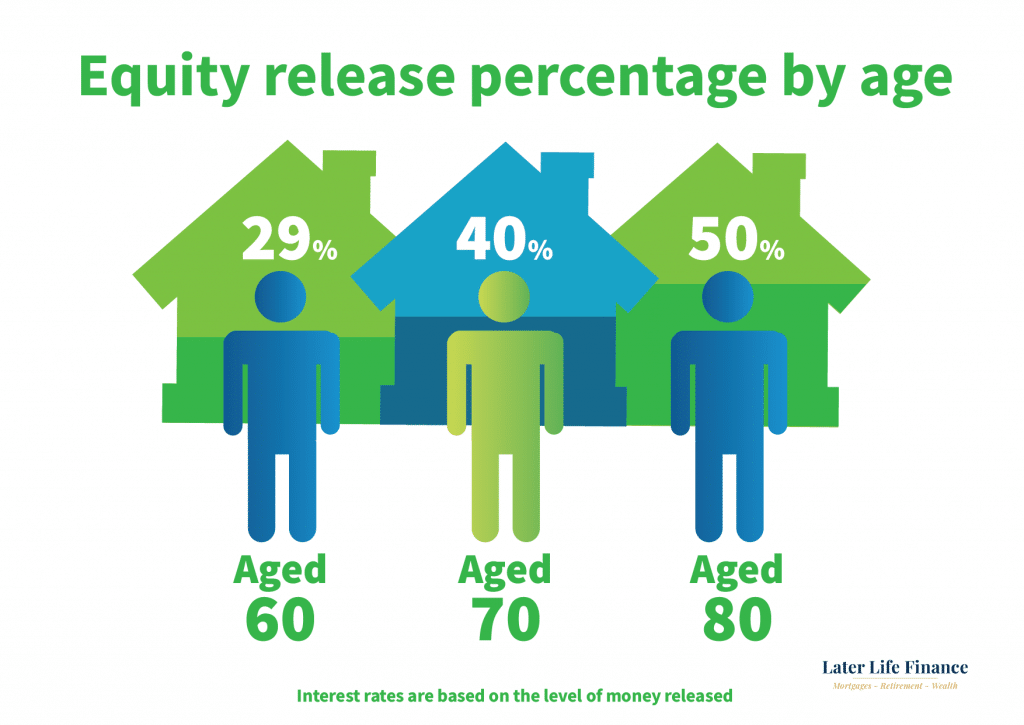

The maximum loan to value is based on the age of the youngest homeowner.

From age 55 you could release around 22.5%, and this increases every year you get older, by 1% up to a maximum of 55% at age 90.

The new interest only lifetime mortgages allow you to release a higher percentage based on age. You could, subject to your income, raise around 55% at at 55 on this type of plan.

Our lifetime mortgage calculator is free and provides instant results.

You may be wondering if lifetime mortgages are a good idea and if they are suitable for your needs.

To compare the top 10 equity release companies, we have reviewed and listed the best providers to help you compare your options, including lender features, such as downsizing protection, voluntary repayments and more.

What are the typical percentages available with equity release?

How much equity can i borrow?

An equity release calculator will estimate how much money you could release from your home.

Your age, estimated property value and whether you have a mortgage determine the options available to homeowners in the United Kingdom.

If you are considering raising the hidden wealth from your home and how much you can borrow on a lifetime mortgage, it’s an option to consider. A cash injection to enhance your best years may be attractive, but it’s important to get the right solution for you.

Later Life Finance are a specialist lifetime mortgage broker. If you decide to proceed with an application, our experts will help you without any pressure, obligation or upfront fees.

We discuss your all your equity release lifetime mortgage options, advantages and disadvantages and the alternatives to consider, and have access to the whole market for your added peace of mind we will find you the best deal available.

We look at all available lenders, including Aviva, Legal & General, Liverpool Victoria and more.

Get a personalised quote from our experts

Later Life Finance are a specialist lifetime mortgage broker and provide calculations and quotations from the whole marketplace.

Lifetime mortgages can be taken out for many reasons. From remortgages to home improvements to your home, to give a helping hand to your loved ones with an early inheritance, a dream holiday, or to boost your retirement finances.

The lifetime mortgage and interest are repaid from the sale of your home when you (and your partner, for a joint lifetime mortgage) pass away or go into long-term care.

Lifetime mortgages also allow voluntary repayments to reduce or avoid the effect of compound interest.

In this article we will explore the best equity release calculator to use and how to find the best equity release company with our expert broker service.

Equity release calculations for interest payments

For an accurate quotation based on your specific requirements, Later Life Finance provide detailed calculations to help you understand your options

Later Life Finance are experts in equity release lifetime mortgages and retirement interest only plans.

Our service includes detailed illustrations, projections and voluntary repayment figures.

- Free calculation and quotations

- Highly experienced advisers and access to bespoke lending terms

- Guaranteed lowest interest rates

- No negative equity guraantees

- Monthly repayment option guarantees

Compare different equity release plans: Lump sum and drawdown schemes

We help you compare different equity release plans and calculate the interest costs for you, and explain the advantages and disadvantages of each equity release provider and plan.

For example, we will calculate the difference between a lump sum and drawdown lifetime mortgage to help you understand the most cost effective option.

Understand the benefits of making voluntary repayments

We help you compare different later life mortgages, payments and lender criteria.

Our mission is to ensure you receive the best solution for your requirements.

Modern plans allow regular repayments to keep you in full control of the interest and your equity.

Making voluntary repayments to the mortgage will help control the compound interest charged against the plan.

How age and property value determine the maximum equity you can release

The age of the youngest homeowner and the value of your home both determine the amount of equity you can release.

The value of your home determines the amount of equity available. Lifetime mortgage lenders use a percentage of the property value based on your age.

Your health can also enhance the lending options available to you

Health and lifestyle can affect the amount of money available with enhanced lifetime mortgages.

For example, a smoker with angina could raise more equity than a non smoker with no health conditions.

Your calculator results: What it means

The equity release calculator provided on the page is to give an indication of the percentage of borrowing available on a lifetime mortgage.

For optimal results, our qualified equity release advisers will provide you with detailed calculations and projections based on your personal circumstances.

What are the next steps?

The next step is speaking with our qualified advisers to understand which equity release interest rate, plan and lender suit your specific requirements, such as current and longer-term plans.

We’ll explore various types of calculators, the factors that affect calculations, and the importance of seeking independent advice when navigating the world of equity release.

So let’s dive in and discover how to get an accurate estimate with our free equity release calculator.

Get your free calculation...

Equity Release for second or holiday homes

If you are considering releasing equity to buy a second or holiday home, an equity release calculator can help you determine how much money you could potentially access. With our equity release calculator, you can input details such as the current value of your property and your age to get an estimate of the amount you could release.

By using an equity release calculator for your second or holiday home, you can have a better understanding of your options without having to commit to anything. It allows you to explore the potential release of funds without the need for a face-to-face appointment with an advisor.

Using An Equity Release Repayment Calculator: Reducing Compound Interest

Equity release repayment calculators allow you to calculate how much compound interest you will save by making regular repayments to your lifetime mortgage.

By providing the option of making voluntary repayments, this can help reduce the effect of compound interest and preserve more equity in your home.

Later Life Finance have access to market leading equity release repayment calculators and research tools to help you calculate how much money you can save by making payments to your lifetime mortgage.

Equity Release Mortgage calculator: Finding The Best Remortgage Deal

Equity release mortgage calculators provide homeowners with the facility to calculate how much equity you can release via lifetime mortgages.

These later life mortgages are more flexible and provide the over 55’s with the facilities to raise tax free cash from the home without any mandatory monthly repayments, but still providing the option of voluntary repayments which can help reduce the effect of compound interest.

Later Life Finance have access to market leading equity release mortgage calculators and research tools which provide figures based on age, health and property value.

Is there a free equity release calculator from the BBC?

The BBC don’t offer an equity release mortgage calculator as you need to access figures from a specialist broker. This ensures homeowners in the United Kingdom are obtaining accurate information on equity release and lifetime mortgages.

As an alternative to an equity release calculator from the BBC, we provide detailed calculations and projections to help you understand how releasing equity will affect the remaining equity in your home.

Aviva Equity Release Calculator

Aviva are a large equity release lender and offer popular solutions for homeowners in the United Kingdom, however their equity release calculator will only provide figures from one lender, whereas dealing with a broker provides access and comparison to the whole market, including Aviva’s equity release plans.

I have known Paul for a number of years, and he is very professional & knowledgeable and always goes the extra mile for his client's. I would have no hesitation in recommending Paul to any potential clients requiring equity release. Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage.

Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage. Brian Bircham13/02/2024Very good

Brian Bircham13/02/2024Very good Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers!

Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers! Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance.

Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance. Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation.

Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation. Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted.

Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted. Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services.

Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services. Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw.

Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw. Jeffrey Wade07/01/2021

Jeffrey Wade07/01/2021

Book a free call back with our expert advisers

Summary

In conclusion, equity release calculators can be valuable tools in helping you estimate the amount of money you can release from your property.

Remember, the key to getting the most out of Later Life Finance’s calculator tools is understanding your options and making the best choice for your individual circumstances with an equity release calculator tailored to your specific requirements.