Later Life Mortgages in 2024: The Complete Borrowing Guide

Compare later life mortgage lenders & interest rates

Access a whole of market, independent broker experience you can rely on for stress free, expert advice.

We are FCA Authorised under Reference 959556.

Table of Contents

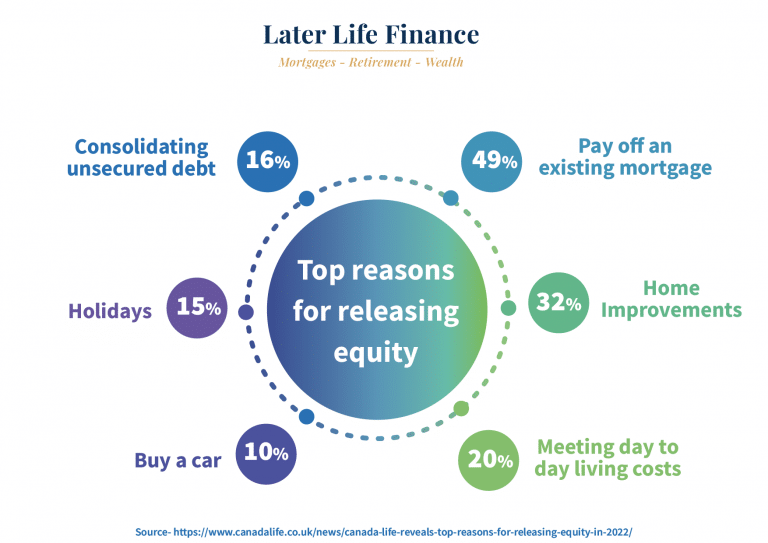

The most popular reasons for using later life mortgages in 2024

Owning a home is a significant milestone in life, but as you grow older, your later life mortgage requirements and goals may change.

Unfortunately, high street banks and building societies don’t offer flexible solutions for their customers reaching the end of their mortgage terms.

Later life mortgages can be used to leverage the equity in your home to support your retirement, cover unexpected expenses, fulfil lifelong dreams, or fund care in the home.

If you are considering how much equity you can release from your home, where downsizing is an option for many, although some homeowners in later life are not quite ready to move home.

What is later life mortgage lending?

Our expert Later life mortgage advisers can offer a financial solution which provides older homeowners with the opportunity to access the equity in their homes without having to sell or downsize. This type of mortgage is designed specifically for individuals aged 55 and above, allowing them to borrow against the value of their property. With later life mortgage lending, retirees can use the funds to cover various expenses, such as home renovations, medical bills, or to supplement their retirement income.

Furthermore, later life mortgages offer flexible repayment options, allowing borrowers to make monthly repayments, repay the interest only, or choose not to make any payments at all during their lifetime. The loan is typically repaid when the homeowner passes away or moves into long-term care. Later life mortgage lending can empower with the financial freedom and flexibility to enjoy retirement years.

Understanding later life borrowing: What are the Best Later Life Mortgages?

These mortgage products are tailored for homeowners aged 55 and above for borrowing against the cash (equity) in their home.

Later life mortgage products consist of equity release, lifetime mortgages, and retirement interest-only mortgages.

Some lenders offer competitive interest rates, while others focus on flexibility in interest or full repayment terms.

It’s essential to research and compare options to find the best equity release mortgages for your needs.

Later Life Finance provide a complete later life mortgage broker service to help you navigate the range of options with later life mortgages. We have an equity release calculator with no personal details to help with your research before committing to providing your information.

I have known Paul for a number of years, and he is very professional & knowledgeable and always goes the extra mile for his client's. I would have no hesitation in recommending Paul to any potential clients requiring equity release. Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage.

Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage. Brian Bircham13/02/2024Very good

Brian Bircham13/02/2024Very good Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers!

Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers! Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance.

Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance. Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation.

Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation. Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted.

Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted. Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services.

Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services. Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw.

Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw. Jeffrey Wade07/01/2021

Jeffrey Wade07/01/2021

What Is a Later Life Mortgage: A Closer Look

Later life mortgages, also known as retirement, lifetime, and equity release mortgages, are financial solutions which allow homeowners over 55 to access the equity tied up in their properties without the need to sell or move.

They provide a way to release funds for various purposes, such as supplementing retirement income, home improvements, or gifting to loved ones.

Mortgages in Later Life: Providing Solutions in Retirement

Mortgages in later life offer a solution by allowing homeowners to use the equity in their homes to meet many financial objectives.

Whether you’re looking to fund healthcare expenses, travel, or support family members, mortgages in later life provide a means to access tax free wealth accumulated in your property.

Later Life Mortgage Interest Rates: What Are The Options?

Selecting the right lender is crucial when considering later life mortgages.

Familiar names including Aviva, Legal & General and Canada Life are just a few of the later life mortgage lenders available.

Later Life Finance provide a whole of market broker service and compare later life mortgage lenders, schemes and interest rates.

Selecting the correct later life mortgage lender depends on several factors which our friendly mortgage experts will discuss with you and explain the options in detail.

Later Life Mortgage Lenders: Choosing the Right Company

Selecting the right lender is crucial when considering later life mortgages.

Familiar names including Aviva, Legal & General and Canada Life are just a few of the later life mortgage lenders available.

Later Life Finance provide a whole of market broker service and compare later life mortgage lenders, schemes and interest rates.

Selecting the correct later life mortgage lender depends on several factors which our friendly mortgage experts will discuss with you and explain the options in detail.

Lifetime Mortgages For Later Life Borrowing

A lifetime mortgage is a type of loan secured against your property, enabling you to borrow some of the equity present in your home while still residing there.

The primary benefit of lifetime mortgages is that they provide homeowners with the opportunity to secure tax free equity for remortgages, lifestyle spending and the option to gift an early inheritance to family.

The duration of lifetime mortgages is generally until the property is sold or the borrower passes away.

The equity released from a lifetime mortgage can be used for many purposes, such as assisting family members onto the property ladder with an early inheritance, making renovations to the home, settling an existing mortgage, supplementing monthly income, or even purchasing a new home.

Lifetime mortgages allow voluntary repayments to repay the interest and some of the capital. This flexibility makes lifetime mortgages an attractive option for many retirees looking to unlock the value of their property in later life.

Equity Release & Later Life Mortgages

Equity release is a financial product that enables individuals to unlock tax-free cash from the equity in their property for any lawful purpose.

It can be especially beneficial for retirees looking to settle an interest-only mortgage, aid family members in purchasing a property, or make home renovations to improve their quality of life.

There are two primary types of equity release products: home reversion plans and lifetime mortgages.

Home reversion plans involve selling a portion of the property to the lender, while lifetime mortgages are loans secured against the property.

One of the key advantages of equity release is the negative equity guarantee, which ensures that you will never leave a debt to your estate in the event of negative equity arising from the mortgage.

This provides peace of mind and financial security to you and your loved ones.

Additionally, voluntary repayments can be made to maximise the inheritance you can leave for your beneficiaries and prevent compound interest from accruing.

Book a free mortgage review with our experts and compare the market.

Retirement Interest-Only Mortgages

Retirement interest-only mortgages are secured against your home, where the interest is paid off monthly, and the full amount of the loan is to be settled upon the death of the borrower or when they vacate the property.

This type of later life lending product differs from lifetime mortgages, as retirement mortgages involve fixed monthly payments, whereas lifetime mortgages do not.

To qualify for a retirement mortgage, an income assessment is required, consisting of employed or self-employed income, pensions, and investment income.

While there is a risk of default if the repayments of the retirement mortgage are not met, this option can be an attractive choice for those looking to maintain a steady monthly payment and have a clear plan for repaying the mortgage in the future.

Making the Most of Your Property Value in Later Life

Your property value is a crucial factor in determining how much equity you can release and the amount of money you can access through later life lending options.

Therefore, it’s essential to explore different methods to enhance your property value and make the most of your investment.

In this section, we’ll discuss two popular approaches: home improvements and downsizing, also known as deciding on whether to ‘move or improve’.

Home Improvements With Later Life Mortgage Borrowing

Home improvements such as extentions and adaptations can increase functionality, aesthetics and the value of your home.

This can significantly increase the value of your property, providing you with more substantial financial security for your later life years.

Later Life Mortgages can be used to raise equity for extensions and adaptations in later life.

At Later Life Finance we frequently speak with families who are considering moving in together to cater for parents care in the home requirements.

For example, building an annexe or an extension for this purpose.

These projects can range from minor repairs to conservatories, kitchens, bathrooms and garden landscaping.

These improvements can have a significant impact on your property the your enjoyment of your home.

Increasing the value of your home, enhancing your comfort and pleasure, and also economising on energy costs makes it a logical route to consider investing money back into your home.

When planning a home improvement project, it is essential to consider the scale of the undertaking, the materials necessary, and the budget is in place with a contingency fund for any unforeseen costs.

Furthermore, it is prudent to research contractors and obtain quotes and referrals before making a choice.

Finally, it is essential to ensure that any building permissions such as planning consents, architects and inspections are completed before commencing the project.

By investing in well-planned home improvements, you can significantly enhance the value of your property whilst also providing you with the extra space needed if you decide to expand your home for your family to join you.

Downsizing VS Later Life Mortgages: Which is Better For You?

Downsizing in later life refers to the process of selling a larger home and moving to a smaller one, often with the goal of reducing or repaying your mortgage, to reduce living expenses and generating additional funds from your equity.

The primary advantage of downsizing is that it can lower costs and enhance profitability, as it can decrease the amount of money allocated to bills and upkeep.

Furthermore, the money saved from downsizing can be utilised to finance other investments or activities, providing you with additional financial security during your retirement years.

When considering downsizing, it is imperative to ensure that the process is conducted in an equitable and transparent manner.

Additionally, providing support and assistance to those affected by the downsizing is essential to maintaining a positive and healthy living environment. By carefully planning and executing a downsizing strategy, you can make the most of your property value and unlock additional funds for your retirement in later life.

Seeking Professional Equity Release Advice on Borrowing With Later Life Mortgages

As you explore the world of later life mortgages, it’s crucial to seek professional advice to ensure that you make the best decisions for your unique circumstances.

The Equity Release Council is the industry body representing providers, qualified financial advisers, solicitors, and intermediaries in the UK equity release sector, plays a vital role in upholding high standards of conduct and practice in the industry.

In this section, we’ll discuss the role of the Equity Release Council and the importance of finding a trusted advisor for your later life lending journey.

By adhering to the standards and principles established by the Equity Release Council, you can have peace of mind knowing that your rights are protected and that the quality of equity release products is maintained.

Working with a trusted adviser, such as Later Life Finance can help you navigate the complex world of later life mortgages and ensure that you make the best decisions for your financial future.

The Role of the Equity Release Council With Later Life Mortgages

The Equity Release Council is committed to upholding high standards of conduct and practice in the lifetime mortgage industry, monitoring the quality of equity release products, and safeguarding people’s rights through a set of standards and principles.

By adhering to these standards, you can have confidence in the quality of the equity release products and services you receive, as well as the protection of your rights and interests.

The council’s standards and principles guarantee that your rights are protected and that the quality of equity release products is sustained.

By working with a provider or advisor who is a member of the Equity Release Council, you can ensure that you receive the highest level of service and support for your later life lending needs.

This can make all the difference in achieving your retirement goals and enjoying financial security during your golden years.

Finding a Later Life Mortgage Adviser

Finding a trusted advisor is essential when considering equity release and later life lending options.

A trusted advisor is an individual who is experienced in the field and well-informed about the industry, providing judicious and realistic advice without prioritising their own interests.

To find a trusted later life mortgage advisor, it’s crucial to conduct thorough research, request references, and read reviews, as well as ask questions to gain a comprehensive understanding of the advisor’s qualifications and experience.

Later Life Finance are an example of a trusted adviser who specialises in equity release products and services.

By working with Later Life Finance, you can ensure that you receive expert advice and support in navigating the complex world of later life lending.

This can help you make the best decisions for your financial future and achieve your retirement goals with confidence.

Later In Life Mortgage Borrowing:Calculating Your Options

Our free later in life calculator is a valuable tool that can help you estimate how much equity you can release from your property.

By using a free equity release calculator, you can gain a better understanding of the potential financial benefits of later life lending and make informed decisions about whether this option is right for you.

In this section, we’ll discuss how an equity release calculator works and the factors that can affect equity release amounts.

To use an equity release calculator, you’ll need to input information such as your age, property value, and other relevant details. Based on this information, the calculator will provide an estimate of how much equity you can release from your property.

While equity release calculators are not a substitute for professional advice, they can be a useful starting point in exploring your later life lending options.

Factors Affecting Equity Release Amounts With Later Life Borrowing

Several factors can influence the amount of equity you can release from your property, including your age, requested loan to value, marital status, surveyor’s valuation, and property value.

Generally, the older you are, the higher the amount of equity you can release. The requested loan to value (LTV) is also a crucial factor, as a higher requested LTV can result in a lower amount of equity being released.

Other factors, such as marital status, surveyor’s valuation, and property value, can also impact the amount of equity released.

By considering all these factors and using an equity release calculator, you can gain a better understanding of your potential equity release options and make more informed decisions about your later life lending journey.

How Later Life Lending Can Support Your Retirement Goals

Later life lending can provide significant benefits for those looking to achieve their retirement goals. By unlocking the value of your property through equity release, lifetime mortgages, or retirement interest-only mortgages, you can support various financial objectives and enhance your overall quality of life during your retirement years.

In this section, we’ll explore how later life lending can be used to boost retirement income, clear debts, and support loved ones. Whether you’re looking to supplement your pension income, settle existing debts, or provide financial assistance to family members, later life lending options can offer the flexibility and financial security you need to achieve your retirement goals.

By understanding the various types of later life finance products and working with a trusted advisor, you can make the most of your property value and enjoy a comfortable, secure retirement.

Boosting Retirement Income With Later Life Mortgages

Later life lending options, such as equity release and lifetime mortgages, can be an effective way to augment your retirement income. By accessing the value of your property through these lending options, you can supplement your pension income and enjoy a more comfortable retirement.

Lifetime mortgages and equity release products provide the flexibility and financial security needed to support your retirement income goals. By working with a trusted advisor and exploring your later life lending options, you can ensure that you make the best decisions for your financial future and enjoy a comfortable, secure retirement.

Clearing Debts With Later Life Mortgages

Later life mortgages can also be used for the settlement of debts to reduce your outgoings increase your disposable income.

By releasing equity from your property through equity release or later life mortgages, you can generate the funds needed to clear debts and reduce monthly outgoings.

Whether you’re looking to settle an existing mortgage or pay off other debts, later life lending options can provide the financial flexibility and security needed to achieve your debt-free goals.

By exploring your later life lending options with a trusted advisor, you can find the best solution for your financial needs and enjoy a more secure retirement.

Supporting Loved Ones With Later Life Mortgages

Later life lending can also provide financial support to your loved ones, enabling you to assist family members in purchasing a property, funding education, or covering other expenses.

By unlocking the value of your property through equity release or later life mortgages, you can generate the funds needed to support your family members and help them achieve their financial goals.

The flexibility and financial security offered by later life lending options can be invaluable for those looking to support their loved ones in achieving their goals.

By working with a trusted advisor and exploring your later life lending options, you can ensure that you make the best decisions for your financial future and provide the support your loved ones need.

Summary

In conclusion, later life mortgages, including equity release, lifetime mortgages, and retirement interest-only mortgages, offers a wealth of possibilities for retirees looking to unlock the value of their property and achieve their retirement goals.

Understanding the various types of later life lending products, making the most of your property value through home improvements and downsizing, and seeking professional advice, you can make informed decisions about your financial future and enjoy a comfortable, secure retirement.

As you embark on your later life lending journey, remember the importance of working with a trusted advisor and exploring all the available options.

By doing so, you can ensure that you make the best decisions for your unique circumstances, unlocking the full potential of your property wealth and supporting your retirement goals.

Later Life Finance can advise you on all your later life mortgage options and start planning for a brighter, more secure future today with later life mortgages.

Get your free later life mortgage calculation...

Next, book your market comparison with your free review