Equity Release London: Discover Your True Wealth Potential in 2024

Deal Direct With a Broker & Access The Lowest Percentage Interest Rates in the Market, Guaranteed.

We're Trusted By 1000's UK Homeowners For The Best Deals From The Whole Market.

Get your free calculation..

Updated December 2023

Equity Release in London: Everything You Need To Know In One Place

Equity release in London provides homeowners with greater flexibility than ever to safely enhance their finances in Later Life.

Interest rates are expect to level out in 2024 and demand continues to grow.

But what are the best options, companies, deals and advice to ensure you make the best decision for you and your home?

We consider the benefits of equity release in London and review how to access expert advice:

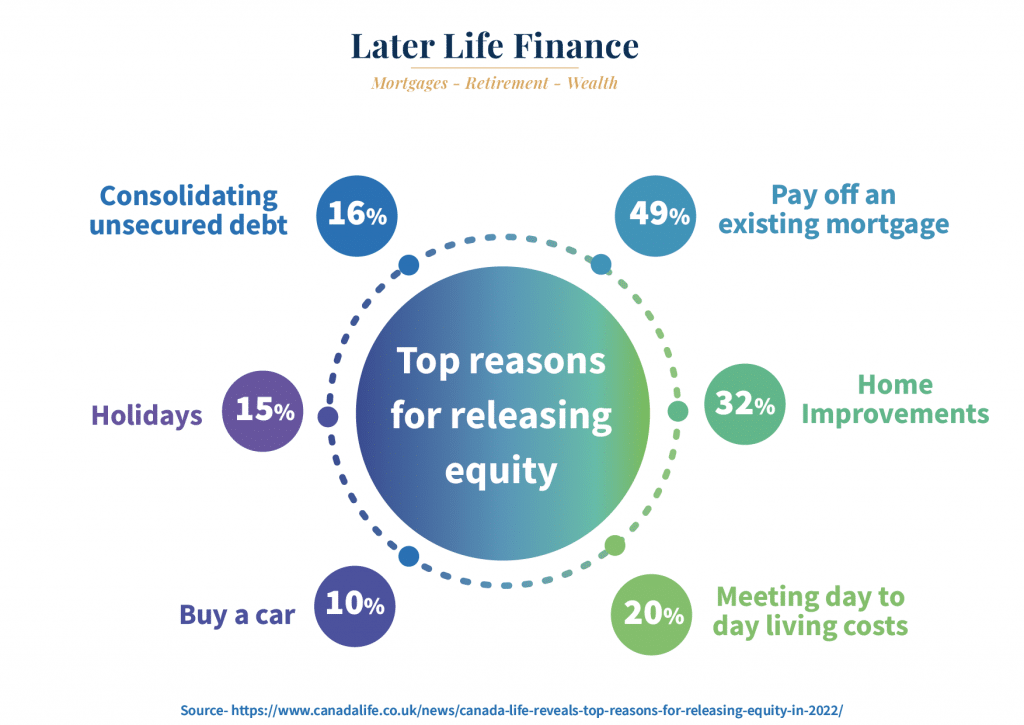

- Raise tax free equity to boost finances and settle existing mortgage lending

- Learn how to setup a lifetime mortgage to avoid compound interest and preserve your equity

- Access broker exclusive deals, cash backs and expertise to save you time and stress when exploring and arranging lifetime mortgages.

Table of Contents

Deal Direct With a Broker & Access The Lowest Percentage Interest Rates in the Market, Guaranteed.

We're Trusted By 1000's UK Homeowners For The Best Deals From The Whole Market.

Equity release advisers in London: Advice you can rely on

As a specialist broker, Later Life Finance can help you navigate your options to identify the most suitable solution for your plans with independent equity release advice.

Dealing direct with a broker means you will access the lowest interest rates in the market, guaranteed. You also benefit from accessing all lenders in one place to save you time and hassle dealing with multiple companies.

Whether you need a remortgage solution, you’re considering inheritance tax planning, gifting an early inheritance, or simply enjoying the retirement you truly deserve, your home is also an asset which can be used to transform your retirement.

If you are also considering how equity release affects inheritance tax, this is an area worth investigating further with our experts at Later Life Finance, as many of our clients have tapped into their wealth as part of a wealth planning strategy.

We are an FCA authorised broker for your peace of mind and safety, and we’re members of the equity release council.

Sourcing the best equity release interest rates through a broker

Later Life Finance have access to the whole equity release market and exclusive deals, free valuations and cash backs.

As a broker, we fully understand the whole market to ensure you receive a level of expertise and knowledge to put you in the best position to make an informed decision.

With Later Life Finance you’ll never miss out on the very best Interest rates.

Book a free review today & compare the market with our experts.

To discuss the current and best equity release interest rates call us on 0800 2465228 for the up to date and exclusive deals.

Equity release mortgages in London: Comparing the top deals

As experts in equity release mortgages for older borrowers, we firmly believe in providing you with the best experience possible, with free initial advice.

We provide free initial advice, detailed calculations and projections to discover all your options & access a friendly expert broker service you can rely on.

1.No call centres, speak with experts & compare the top deals from the whole market.

2.Understand all your options to release money from your home with a safe plan.

3. Access Broker Exclusive Deals

- Ask any questions or concerns you have with our qualified advisers

- Learn how voluntary repayments can help preserve more of your equity

- Access calculations, projections and interest costs

- Find out how the different equity release plans work in London

- Find out more about the latest offers available

- Discuss whether any entitlements to means-tested benefits may be affected

- Understand the impact on the value of your estate

- Discuss other borrowing options available

- Work with your qualified adviser to see whether equity release is right for you

The old adage: Fail to plan, plan to fail is especially relevant when dealing with financial services; especially with lifetime mortgages.

Dealing with genuine experts will help avoid pitfalls later down the line.

Help family with a gift

Dream Holiday

Cash Lump Sum

Pay Off your Mortgage

Contact our experts on 0800 2465228

How much can I borrow with a lifetime mortgage in London?

How much can you borrow with a lifetime mortgage in London?

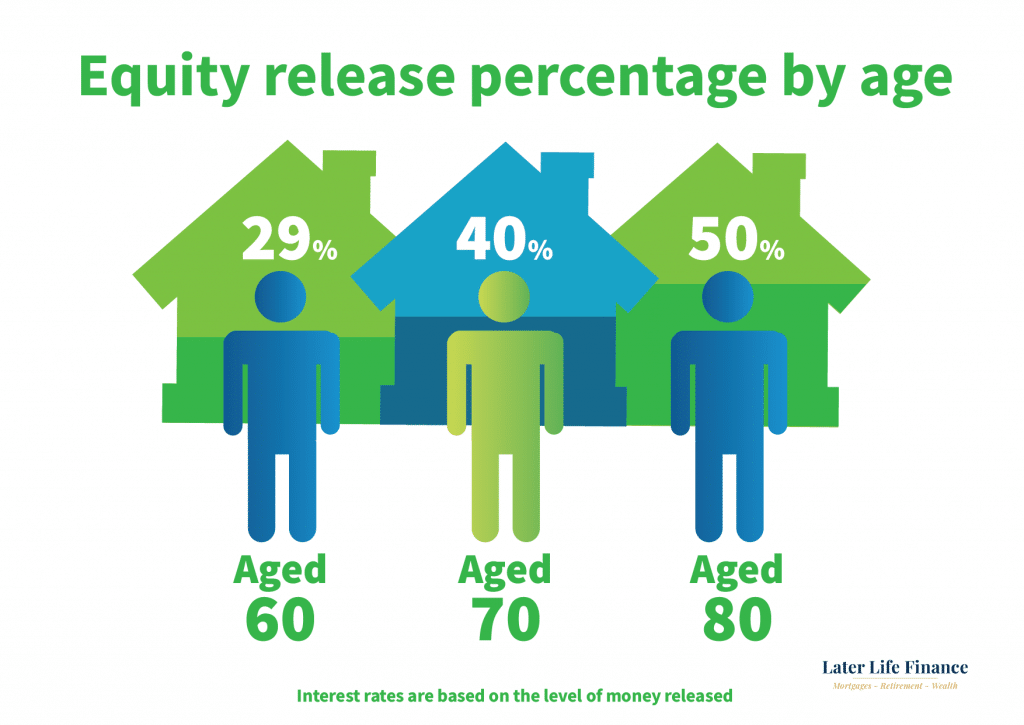

From age 55 you could release around 22.25%, and this increases each year by 1% up to around 55% at age 90.

For example, a 60 year old could release around 29%, a 70 year old could release around 40%, and an 80 year old could release around 50%.

I have known Paul for a number of years, and he is very professional & knowledgeable and always goes the extra mile for his client's. I would have no hesitation in recommending Paul to any potential clients requiring equity release. Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage.

Mark Eastwood16/07/2024Cant than Paul enough for his help. Totally proffecional all the way from our first conversation to our last. Thank you Paul for arranging our life time mortgage. Brian Bircham13/02/2024Very good

Brian Bircham13/02/2024Very good Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers!

Michael Dilucia08/07/2023My equity release application had been rejected 3 times when I was referred to Peter at Later Life. He was extremely thorough, patient, friendly, and knowledgeable. He helped us with every step of the application and explained everything clearly and patiently. We finally succeeded in getting the equity release we wanted. I cannot recommend them highly enough. Their service goes above and beyond. Very happy customers! Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance.

Sherry Izadi08/07/2023Paul has been a rock throughout the most traumatic time of my life. His patience has been endless as I was clueless about my financial complications after the death of my husband. I recommend his services to anyone out there needing his advice and guidance. Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation.

Hazel Franklin20/10/2022Paul Murphy was superb in sourcing and arranging my lifetime mortgage and his professionalism was second to none. I would recommend him without reservation. Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted.

Tony Holloway31/03/2022Paul did a first class job helping me secure a great rate for my equity release proposition. I like the idea of equity release but at the right rate Paul was competitive and at the expense of his own commission made it happen. I really felt I was the focus not him. The big firms with the fancy marketing were almost twice as much in terms of all- important compound interest. I highly recommend Paul, he works for you, not 'them'. I also felt safe with the solicitors he recommended, they too sent a first class guy who was a pleasure to work with. Equity release is not cheap, it's vital that people like Paul work for your best interest (pun intended). What price can you place on the latter peace of mind having financial security brings. Highly delighted. Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services.

Mike Murray31/03/2022We have used Paul's services twice in just over a year. Initially it was to change provider as better interes rates were available. On the annual review it transpired that no early repayment charges would be levied. Being a Yorkshire man l searched for best rates, providers and advisors and it was back to Paul. I have no loyalty where money is concerned but transparency, knowledge and reliability are paramount. That's exactly what we got. Good service, excellent communication, expedience and saved money. Second time around not even a direct fee to pay for the service. Another provider did come up with an option however their fees were somewhat prohibitive, when l brought this to their attention they offered to slash the fee. Not good practice. So after all the waffle. I have no reservations in recommending Paul's services. Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw.

Anthony Grey08/09/2021We had reservations about Equity Release plans and approached a number of leading companies. Glad we settled with Paul Murphy and Responsible Life. He was patient and personable and guided us through the process. We received a most professional service, never felt under pressure. The plan is now in place. Excellent communications throughout. No hesitation, would highly recommend Paul. Jw. Jeffrey Wade07/01/2021

Jeffrey Wade07/01/2021

Contact our experts on 0800 2465228

Get your free equity calculation...

Contact our experts on 0800 2465228

Lifetime Mortgages in London

A lifetime mortgage in London is a way for homeowners to release equity from their property.

This type of mortgage allows individuals to borrow against the value of their home, with the loan being repaid when they either sell the property or pass away.

A lifetime mortgage is a loan secured against your property, with the amount borrowed and interest repaid when you die or move into long-term care. This type of equity release product allows you to:

-

Access the value in your home without having to sell it

-

Provide you with additional funds to meet your financial needs

-

Retain ownership of your property

It is important to consider the implications of taking out a lifetime mortgage, as it is a long term mortgage.

London, being a high-value property market, is a popular location for homeowners to consider a lifetime mortgage as a way to access funds for things such as home repairs, debt consolidation, or helping family members financially.

There are several providers in London that offer lifetime mortgages to eligible homeowners. These mortgages come with different features and interest rates, so it’s important for individuals to carefully consider and compare their options before making a decision.

By working with a qualified mortgage advisor in London, homeowners can receive expert guidance tailored to your specific needs.

We help you navigate the process and choose the most suitable lifetime mortgage for their financial situation and goals.

Lifetime mortgage advisers in London: Independent expert advice

To fully understand the features available, it’s crucial to obtain independent lifetime mortgage advice to understand all your your options to make voluntary repayments, and compare the entire market to ensure a lifetime mortgage is the most suitable solution for your requirements.

We help you explore and discover flexible equity release solutions to enjoy your retirement years in financial security.

Modern plans offer a fantastic range of features including voluntary repayments, overpayment options with the option to downsize and repay or port the mortgages.

Later life finance are an independent lifetime mortgage broker specialising in lifetime mortgage advice in London and across the UK.

Can you be refused Equity Release in London?

Whilst mainstream mortgages are income and affordability based, equity release lifetime mortgages are not, meaning the chance of being refused equity release is very slim.

Lifetime mortgages applications are based on the age of the homeowner and the value of the property. A valuation of your home is carried out and this determines whether the application will be successful.

Non standard properties can be refused equity release, along with properties near commercial premises, or in poor condition.

If your home is standard construction in good condition, there is little chance of the application being refused.

Equity release on flats is fairly common; as long as an acceptable lease is in place and there are no lending issues noted above, refusal of equity release is unlikely.

What are the typical percentages available with a lifetime mortgage?

Contact our experts on 0800 2465228

Can you be refused a lifetime mortgage in London?

What are the different types of lifetime mortgages in London?

When must the lifetime mortgage be repaid?

Who are the best lifetime mortgage providers in London?

- LV=

- Legal and General

- LiveMore

- More2Life

- OneFamily

- Pure Retirement

- Scottish Widows

- Standard Life.

- Royal London

- Canada Life

- Aviva

- Just

Is there a credit check for a lifetime mortgage in London?

As part of the application process for a lifetime mortgage, the lender may check your credit report.

Since lifetime mortgages do not have mandatory repayments, any missed payments on credit are not necessarily an issue for lending.

If you have any defaults or CCJ’s on your credit agreements, the lender may require these to be settled.

Any secured lending must be settled as part of the agreement as a lifetime mortgage is the first legal charge on the property.